Introduction

An initiative of the Asia-Pacific Regional Bureau, the Internet Society Survey on Policy Issues in Asia-Pacific is an annual survey of the attitudes of Internet users towards topical Internet policy concerns. Now in its sixth instalment, this year’s survey focuses on consolidation in the Internet economy—a growing concern that a handful of large corporations are dominating the online world and shaping its functionality.

At the beginning of the year, the Internet Society published the 2019 Global Internet Report[1] on this issue as a starting point for exploring what this concentration of power means for the future of the Internet. As part of developing the global report, a global survey[2] was conducted last year. The global report discussed the trends and impact of consolidation in three layers of the Internet economy—in applications, access provision and service infrastructure. This regional survey looks at consolidation in the applications layer. More specifically, the survey focuses on the role that Internet giants have in shaping Internet usage and users’ experience in the region, and how they may impact future innovation on the Internet. A summary of the survey results is available online.[3]

They have been given acronyms like “GAFAs” (Google, Apple, Facebook, Amazon), “FANGs” (Facebook, Amazon, Netflix, Google) and “BATs” (Baidu, Alibaba, Tencent), these Internet giants are providing Internet users with incredible convenience on their application platforms. Their platforms have become the primary means for gaining access to the Internet, for news, buying and selling services, and education, as well as for interacting with friends and family, businesses, and government. Furthermore, these Internet giants are expanding from their areas of dominance—e.g., Google’s search, Facebook’s social media platforms and Alibaba’s e-commerce sites—and extending their influence and reach into new domains through acquisitions, new product developments, advancements in artificial intelligence and investments in the network infrastructure.

This year’s regional survey aims to contribute to policy debates and discussions—both in the region and globally—on the trends and impact of consolidation. The survey also examines the top Internet-related policy concerns in the region.

Background and Methodology

The survey was conducted online using the Survey Monkey platform, and ran from 1 to 31 July 2019. The link to the questionnaire was disseminated via email through the 22 Internet Society Chapters to Internet Society individual members in the Asia-Pacific region. The survey was also announced in the Asia-Pacific Regional Bureau’s monthly newsletter—APAC Connections, and on social media platforms. It was open to the general public to gain as much input as possible.

The survey was administered in English and divided into three main sections. The first set of questions aimed to solicit views on consolidation in the Internet economy, while the second section sought to identify the top Internet-related policy concerns in the region. The third section helped to determine the profile of the sample population.

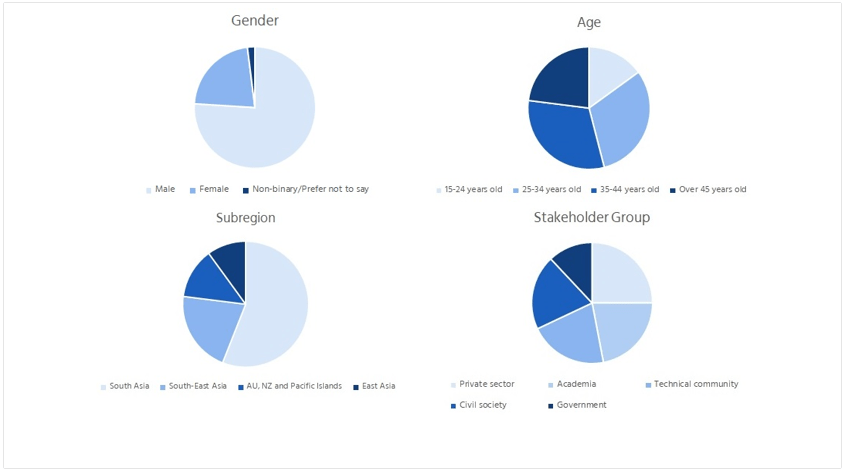

Some 1,322 individuals from 39 economies across Asia-Pacific answered the survey. Over half of the respondents self-identified as residing in or originating from South Asia (56%), with the rest coming from South-East Asia (21%); Australia, New Zealand and the Pacific Islands (13%); and East Asia (10%). The majority (90%) are members of the Internet Society, and are male (76%). Respondents are scattered across all age groups, but lean towards a younger demographic—15% are 15-24 years old, 31% are aged 25-34, another 31% are 35-44, and the remaining 23% are 45 years or older. Respondents are quite evenly distributed across stakeholder groups—25% are with the private sector, 22% with academia, 21% with the technical community, 20% with civil society (including non-governmental organisations, media, individuals and students) and 12% with government (see Figure 1).

Figure 1. Summary of respondents’ profile

It should therefore be noted that the results of this survey are more weighted towards perspectives from South Asia, and a young, tech-savvy male population. Nevertheless, this report has looked at, and presents both the overall and disaggregated findings based on gender and subregion.

Key Findings

1. The majority of Asia-Pacific Internet users depend on Internet giants like Facebook, Microsoft and Alphabet (Google) for their online activities.

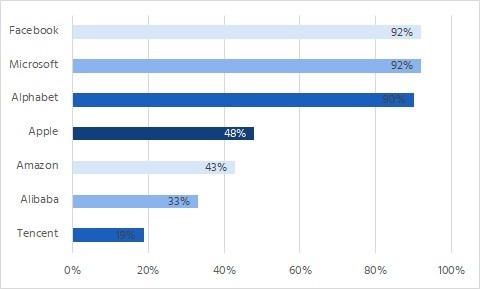

Figure 2. Products and services used by survey respondents[4]

Over 90% of respondents use the products and services of Facebook, Microsoft and Alphabet (Google), and almost all respondents (96%) depend in some way on the products and services from these companies for most of their online activities.[5] A similar percentage indicated that to some extent, these companies also influence how they use and access the Internet.[6] Moreover, almost half of the respondents believe that it will be either very difficult or difficult to find a suitable replacement for the products and services offered by these Internet giants. This dependency on a few large players for Internet services that cannot be substituted is one of the consolidation trends that many believe is occurring globally.

2. Overall, Internet users in the region would like more choices online.

Generally, users’ ability to choose allows them to remain in control of their Internet experience. Some 60% of the respondents prefer to have the ability to choose online products and services from more than five companies, while 40% prefer to do everything online using five companies or less.

One respondent commented that: “I’m not interested in more choices once I have made my choice.” The success of large Internet platforms has been driven by convenience and by providing easy access to useful and targeted products and services.

There are some differences by region and income group. For instance, in Pacific Island countries,[7] almost 60% of the respondents prefer using products and services from five companies or less. However, in high-income countries,[8] almost 70% prefer to have more choices. In South-East Asia,[9] the split is 50%-50%.

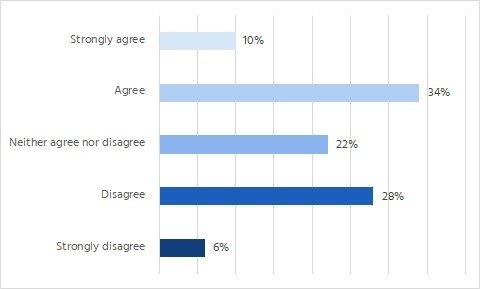

Forty-four percent of respondents believe that the applications and services available to them are more limited now than five years ago (see Figure 3).

Figure 3. Level of agreement on the statement that choices for online products and services are more limited now than five years ago

For those who would like to see more choices, about 80% of respondents indicated that they would like to have a greater variety of e-commerce websites and apps, and 60-70% of respondents would like a wider selection in search engines, social media platforms and email providers.

3. Security is Internet users’ top concern.

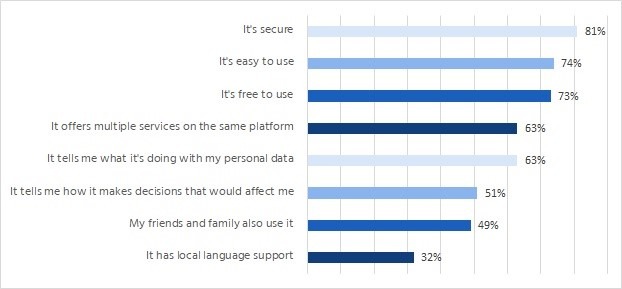

Security is the foremost factor influencing users’ decision to move to a different online service, app or platform (see Figure 4).

Figure 4. Factors influencing users’ decision to move to a different online service, app or platform

Four in five respondents report that they would move to a different online service, app or platform if it is secure. Cybersecurity has been the topmost concern among Internet users in the region for three years in a row (see point no. 6 below).

New services, apps or platforms that are easy to use, free of charge, offer multiple services on the same platform, and inform users how their personal data is being processed are likewise appealing to respondents. The latter may indicate greater awareness of data protection rights with users wanting to know how their personal data is being used, and want to be reassured that it is being properly handled.

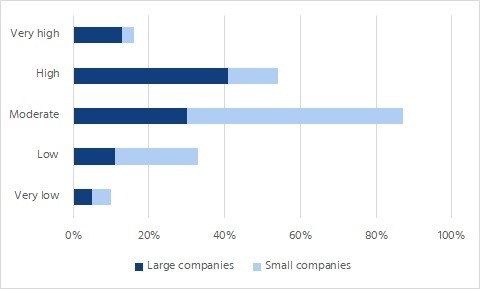

4. Asia-Pacific Internet users trust large Internet companies more than small ones.

While over half of the respondents have a high level of trust in large Internet companies, only 16% of the respondents have the same level of trust for small Internet companies.

Figure 5. Respondents’ level of trust in large and small Internet companies

These large Internet companies have an extensive customer base, and should users’ trust towards them be diminished or broken, the implications on the value of the Internet may be dire. User trust is important to the success of the Internet because if users do not trust the Internet, they will restrict their use, and may even cease using it for certain activities. This could have a serious impact on the evolution of the Internet, its use and growth.

Trust depends on the security, reliability and stability of networks, applications and services. In the global survey conducted by the Internet Society last year,[10] respondents were divided on the impact that consolidation may have on cybersecurity. Many opined that bigger companies tend to be better equipped to fight cybercrime; but others cited increased vulnerabilities arising from cyberattacks that could have serious consequences when directed at a more centralised system.

5. Internet users in the region expect future innovations to come from both large and small companies.

Over 40% of respondents think that large Internet companies could both enable and restrict innovation. Another 40% believe they enable innovation, while about 10% believe they restrict innovation.

Seventy percent of the respondents, however, expect future products and services on the Internet to come from both large and small companies, and over 80% think that government has a role in promoting innovation online.

The 2019 Global Internet Report noted a trend of large Internet companies being not only the source of innovation, but also the locus of innovation where new innovators build their innovations. The platforms of these large Internet companies offer small and emerging businesses and innovators access to their customer base, resources and expertise. This means that innovation may become concentrated on a small set of proprietary platforms, which could in turn limit competition and user choice.

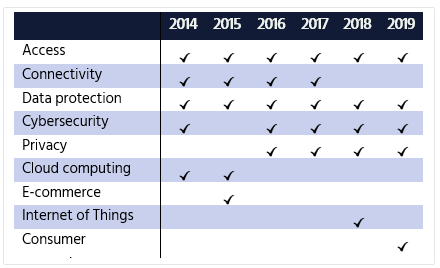

6. For three years in a row, cybersecurity is the top Internet policy concern in the Asia-Pacific region.

Over the past year, Internet users across Asia-Pacific have been monitoring cybersecurity, access, data protection, privacy and consumer protection issues, above other policy-related concerns in the region. These have remained more or less constant since 2014 (see Figure 6). Consumer protection has risen from its usual top ten position to the top five. Other issues that have remained a priority for a number of years now include big data, censorship, connectivity, cybercrime, e-commerce, Internet of things and online child protection.

Figure 6. Top five policy concerns from 2014 to 2019

Cybersecurity is the topmost policy concern in all subregions except in South-East Asia where it is superseded by access.

Respondents note that the new Internet-related policies, regulations and laws that have been adopted in the past year have focused on the issues that they are concerned about, particularly cybersecurity, cybercrime, privacy, data protection and access. Half of the respondents indicate that these have affected the way they use the Internet in both positive and negative ways.

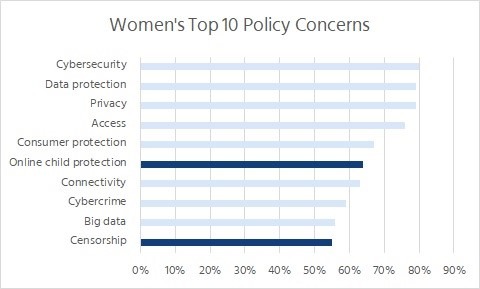

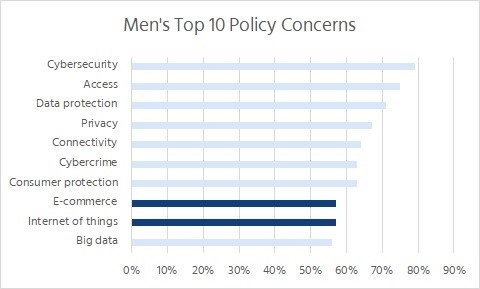

Generally, women and men have similar policy concerns.

The top-ten policy concerns for both the female and male respondents are very similar. The only exception is women prioritising online child protection and censorship, while men seem to pay more attention to issues around e-commerce and the Internet of Things (see Figure 7).

Figure 7. Top ten policy concerns of female and male respondents

Conclusion

The findings of the survey indicate that users and businesses are benefiting from consolidation at the applications layer where a few large Internet companies, predominantly from the United States and China, are providing on their platforms, incredible convenience and access to targeted products, services and markets. But users are aware of and concerned about security and privacy threats.

Asia-Pacific Internet users currently trust large Internet companies more than small ones. This stresses the need for new tech companies and startups to invest in building users’ trust in their online products and services. Moreover, companies and startups can gain a competitive edge by focusing on security, privacy and data protection, and offering products and services that give users more control over the security and privacy of their data.

It is evident that the region would like future innovations to come from both large and small Internet companies. Government needs to make sure that policies targeted at developing the digital economy do not favour large established companies.

We look forward to the community’s continued engagement in discussions on the trends and impact of consolidation on aspects related to user’ choice, consumer and data protection, cybersecurity, and innovation and competition, and how governments and other stakeholders may respond to ensure that the Internet remains open and trusted.

Endnotes

[1] Internet Society, 2019 Global Internet Report: Consolidation in the Internet Economy, https://future.internetsociety.org/2019/wp-content/uploads/sites/2/2019/04/InternetSociety-GlobalInternetReport-ConsolidationintheInternetEconomy.pdf .

[2] Internet Society, Community Survey: Questions and Results, https://future.internetsociety.org/2019/community-survey-questions-and-results/ .

[3] Internet Society, Asia-Pacific Internet Policy Insights 2019, September 2019, http://bit.ly/isocapacsurvey2019 .

[4]Facebook includes WhatsApp and Instagram; Microsoft includes Windows OS, LinkedIn, Skype, MS Office, Microsoft Surface, etc.; Alphabet includes Google, YouTube, Gmail, Google Maps, etc.; Apple includes iPhone, iPad, Apple Pay, etc.; Amazon includes Amazon Alexa, Amazon Marketplace, Amazon Prime Video, etc.; Alibaba includes AliExpress, Alipay, Lazada, etc.; Tencent includes WeChat, Fortnite, League of Legends, Joox, Weibo, etc.

[5] 61% of respondents agree that they depend on the products and services from these companies for most of their online activities, and 35% report that they depend to some extent on these products and services.

[6] Forty-seven percent said giant tech companies fully influence, while 48% indicated that big tech firms to some extent influence how they access and use the Internet.

[7] There are 84 respondents from the following Pacific Island countries: Papua New Guinea (32%), Kiribati (20%), Fiji (17%), Tonga, Vanuatu, Samoa, Solomon Islands, Federated States of Micronesia, New Caledonia, Niue, Cook Islands, French Polynesia and Nauru.

[8] The high-income countries include Australia, Hong Kong, Japan, Republic of Korea, Macao, New Zealand, Singapore and Taiwan, with 212 respondents.

[9] There are 256 respondents from the following South-East Asian countries: Philippines (31%), Malaysia (26%), Indonesia (16%), Singapore (14%), Cambodia, Thailand, Vietnam, Myanmar and Timor-Leste.

[10] Internet Society, Community Survey: Questions and Results, https://future.internetsociety.org/2019/community-survey-questions-and-results/ .