Author: Michael Kende

Michael Kende is a Senior Fellow at the Internet Society. Many thanks to Dawit Bekele for his leadership and vision, and to Sally Wentworth, Konstantinos Komaitis, Jane Coffin, Michuki Mwangi, Verengai Mabika, and Ayden Férdeline for input and advice. Many thanks also to the steering committee of Eng. Martin Obuya, Stephen Ozoigbo, and Didier Nkurikiyimfura for their insights and expertise at every stage of this project, to Internet Society members Joel Okomoli and Thato Mfikwe for their observations, and also for the input from the participants of the Internet Society Africa Regional Internet Development Dialogue, held in Kigali, Rwanda on 8-9 May 2017. Finally, thanks to Daniela Pokorná for expert research assistance.

Introduction

The Internet is a critical enabler of economic growth and opportunity. Globally, in both developed and developing countries, applications and services powered by the Internet have accelerated economic growth and created jobs. Small businesses, in particular, have used the Internet to deliver economic growth to their local communities, harnessing it to overcome traditional barriers such as a lack of access to education or skills, and exporting their products and services to national and international markets.

The benefits the Internet can deliver are clear and well documented. At low cost, and at scale, the Internet has empowered historically marginalized people, including those in regional environments and in conflict zones, with the ability to create and finance businesses, to collect payments, and to receive and disseminate knowledge. But this is just one piece of the puzzle.

Internet-based companies currently represent a single digit percentage of the economy of most African countries. The Internet Society believes efforts should be made to bring the benefits of the Internet to the rest of the economy. A virtuous circle exists — greater demand for Internet-enabled content, applications, and services leads to greater demand from users for Internet access services, which leads to greater taxation generation, greater revenues for telecom operators, greater interest from investors in Africa, and, of course, greater usage of Internet applications and services.

In addition to helping countries make significant progress towards achieving the United Nations’ Sustainable Development Goals, developing an Internet economy facilitates trade:

- Businesses, across all sectors, can be more productive and efficient by harnessing new technology. At the same time, they gain access to a global marketplace of billions of people and millions of companies, and have the opportunity to attract international investment and join international supply chains.

- Citizens in both rural and urban areas benefit from enhanced educational and training opportunities, can raise money for their own innovations, and communicate more efficiently. They also have access to new job opportunities, both in their own country from local startups, and in the international job market working remotely for a foreign employer.

The Internet economy presents a major opportunity for Africa. In this report, the Internet Society highlights how greater usage of the Internet, and digitization of the traditional economy, amplifies economic growth. We look at what needs to be done in Africa to develop such an Internet economy, noting both local successes and broader challenges that need to be overcome for the full benefits of the Internet economy to be realized. We conclude with a series of evidenceinformed recommendations for policymakers in Africa.

Background

The Internet Society promotes the open development, evolution, and use of the Internet for the benefit of all people throughout the world.

Historically, we have sought to address barriers to infrastructure in Africa, be that international connectivity, domestic connectivity, or even the last mile.1 This focus has included significant work developing Internet eXchange Points (IXPs) in Africa to ensure that connectivity is efficient and content is routed domestically.2 More recently, our attention has turned to content infrastructure. We observed that hosting content locally significantly reduced the latency and cost of content delivery, in turn making it more accessible for the local community.3 A recent Internet Society study in Rwanda further demonstrated the importance of developing local content, and the role that local entrepreneurs could play in these developments.4

In this report, we examine Internet adoption and usage by companies and governments throughout Africa. We seek to identify the progress made, and the roadblocks still to be overcome, to create a true Internet economy which delivers innovative new services, job opportunities, and increased incomes across the continent for the benefit of all Africans. This evolution in our work is driven by two recent developments.

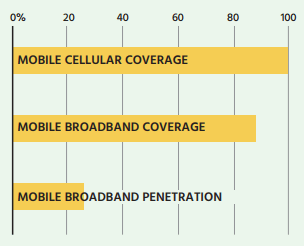

Firstly, Internet access infrastructure is no longer the roadblock to Internet adoption that it once was. While it is not available to everyone, and not affordable to all people, in many countries mobile broadband is now available to a far higher proportion of the population than are using it.5 This is because of the near ubiquitous coverage of mobile cellular networks for voice, which can be relatively cheaply updated to offer mobile Internet services.

The declining demand for Internet among some communities points to the need for more locally relevant content and services provided by businesses to consumers (B2C). During our work, we identified a number of roadblocks to expanding the availability of such services, including the difficulty in monetizing locally developed content, either because of a lack of means for direct payments, or challenges in supporting content indirectly through advertising. We also identified some regulatory barriers to producing, hosting, or sharing some content. Not all consumer content must be market-led; locally

KEY TERMS

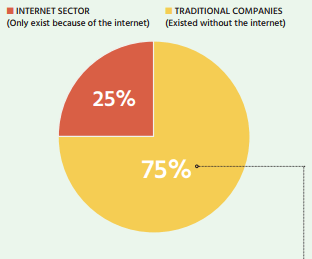

INTERNET SECTOR Companies that exist only because of the Internet and which add significantly to GDP. These include Internet Service Providers (ISPs), content producers and providers, and social media platforms.

INTERNET ECONOMY An economy and society where Internet-connected networks, applications, and services are fully embedded in all economic and social activities.

PLATFORM A foundation through which different networks can interconnect, and different applications and services can interoperate.

“IN THE WORLD DEVELOPMENT REPORT 2016, the World Bank summarized how digital technologies promote development and generate digital dividends: “By reducing information costs, digital technologies greatly lower the cost of economic and social transactions for firms, individuals, and the public sector. They promote innovation when transaction costs fall to essentially zero. They boost efficiency as existing activities and services become cheaper, quicker, or more convenient. And they increase inclusion as people get access to services that previously were out of reach.’” 8

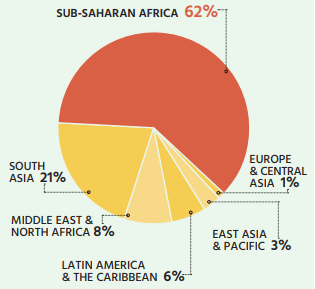

THE INTERNET’S CONTRIBUTION TO GDP IS LOW IN AFRICA

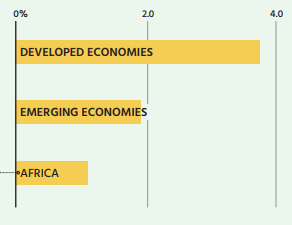

SHARE OF GDP: Research by the McKinsey Global Institute reveals that the Internet sector makes up an average of 3.7% of GDP in developed economies.9 Even in the United States, with its large global Internet companies, the sector was just 3.8% of GDP in 2012. It is even less in aspiring and emerging economies, with the Internet contributing just 1.9% to GDP in 2012. In Africa, the Internet contributes just 1.1% to GDP.

According to the World Bank, the Internet sector makes up 3 to 5% of the workforce in OECD countries, but only 1% in developing countries.

Thus, a focus on developing the Internet sector, while critical for development, will have a beneficial, but ultimately limited impact on the size of the economy, in and of itself.

SHARE OF GDP GROWTHECONOMIC GROWTH: The Internet can have a strong impact on economic growth, and makes up 0.4% of annual GDP growth in developed regions, and 1.3% in developing regions. This growth comes from the impact of the Internet on the rest of the economy.

Where it has been studied, 75% of the impact of the Internet on growth comes from traditional industries, showing the benefits the Internet can deliver for the entire economy.

It has been further shown that a 10% increase in Internet use can increase international trade by 0.4-0.6%.

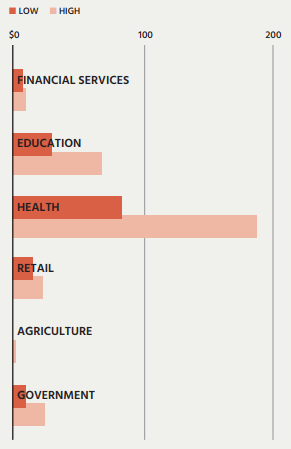

POTENTIAL ANNUAL PRODUCTIVITY GAINS IN 2025 IN AFRICA CREATED BY THE INTERNETPRODUCTIVITY. The McKinsey Global Institute predicts that in addition to its contributions to GDP, the Internet will deliver productivity gains across Africa.

With the right inroads made, these productivity gains across six key sectors are projected to be valued between $148 billion and $318 billion by 2025.

For the healthcare sector, nurses will save 0.5 to 1.0 hour per day. In agriculture, there is likely to be a 10 to 20% increase in production. In the financial services sector, each full-time equivalent employee will annually generate $65,000 more productivity. For African governments, there is a projected cost saving of 60 to 75% on administrative tasks.

Productivity gains above are measured in billions of dollars.

relevant consumer content can also come from government, educational institutions, and other users in a community — directly through messages, or through online platforms such as Facebook and YouTube.

Consumer content is clearly critical to bringing new users online, and increasing the usage of the Internet by those already online. Nevertheless, the Internet economy is much broader than consumer content. The business-to-business (B2B) market is typically much larger than the B2C market, and similarly, e-government services extend beyond consumers.

More broadly, however, traditional industries benefit significantly from Internet access. It can result in the opening of new markets and better information exchange. Consumers can benefit from access to more services and job opportunities, while governments can more efficiently engage with their citizens.

There is significant room for the Internet sector to grow in Africa. The Internet’s contribution to GDP in Africa is low relative to other developed and emerging economies, but if the Internet begins to match or exceed the levels seen in other countries, the impact on the continent’s economic and social development could be immense. As it stands today, there are already signs of growth of the Internet economy in some African nations—but there is great disparity across and within countries on the continent.

Trends in the African Internet Economy

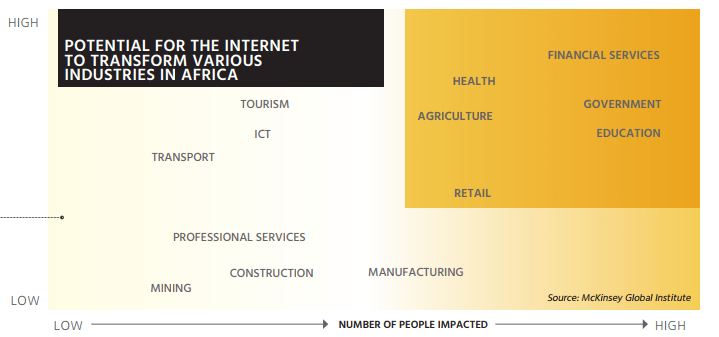

Developing a full Internet economy requires bringing both large and small businesses online, along with governments and other social services. This first requires a healthy Internet sector — widespread, if not ubiquitous, Internet access that is affordable, reliable, and of sufficient bandwidth. In particular, there are a number of sectors where the Internet can have a substantial impact and where it might make sense to initially focus efforts. The McKinsey Global Institute identified six industries in Africa — agriculture, education, financial services, government, health, and retail — as best positioned to benefit from the Internet in the immediate future because of the size of the population that could benefit from innovations in their respective field.

For these industries to capture the full benefits that the Internet can deliver, they are dependent upon high-speed broadband, increases in device penetration, and, in some cases, having a means of online fulfillment. A key facilitator to the development of an Internet economy, for existing industries and new players, are Internet platforms. These platforms can be businesses in their own right, however their significance is in enabling the emergence of new services and applications.

One example of an enabling platform is the M-Pesa mobile money service, which launched in Kenya and is now active in seven African countries. M-Pesa helps other companies develop new online services by providing a convenient means to make and receive payments. This may be particularly important for non-Internet businesses, such as retailers, who can adopt the existing platform and thereby focus on developing their own services. Such platforms, if successful, can evolve into entire ecosystems, as is the case with M-Pesa.

While difficult to quantify the Internet economy in Africa is growing. Overall, Internet access and device ownership is growing in Africa, with more and more people coming online as a result of mobile broadband. We are also seeing the emergence of innovative platforms, which in turn are helping new services and applications to develop. This section highlights these emerging trends, before turning to the significant challenges of developing an Internet economy across Africa.

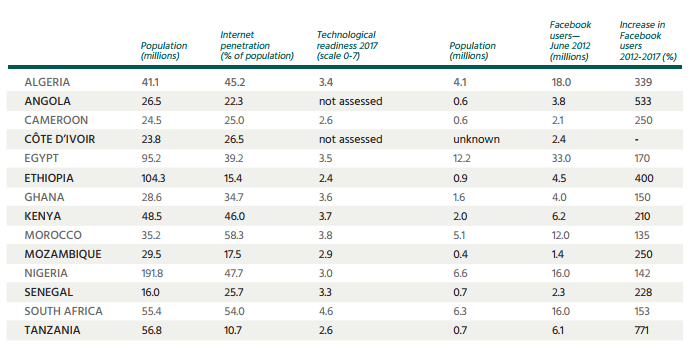

Internet Sector

Internet penetration and usage varies widely across Africa, with urban areas generally having higher Internet penetration rates than rural areas do. As of 2017, 388 million of the continent’s 1.25 billion people are online, with 160 million holding Facebook accounts. In the table below, we chart the progress that the 14 largest economies in Africa are making at getting people online. We see that there remains a great deal of the population unconnected — which means that as penetration increases, so too do the benefits that the Internet can bring. We also observe that all African countries score low on the technological readiness pillar of the World Bank’s Global Competitiveness Report 2017. This is a measurement of the agility with which traditional industries adopt new technology. As we identified previously that 75% of the impact of the Internet on growth comes from traditional industries leveraging the Internet to increase their efficiency and competitiveness, these scores suggest that more work needs to be done.

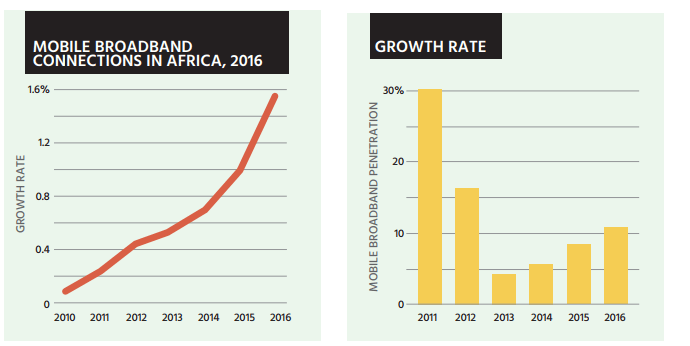

The figure below depicts the increase in the continent’s mobile broadband subscribers. This is an important metric, because most Internet users in Africa depend on mobile broadband in order to access the Internet. Availability exceeds subscribers, with almost 60% of the population living in range of a 3G or 4G mobile broadband signal. Furthermore, 2G mobile cellular signals cover almost 90% of the population, and these networks can be relatively easily updated to offer mobile broadband. This level of Internet access represents significant progress, supporting the growth of the Internet economy.

These 14 countries together comprise 90% of Africa’s GDP. Population numbers are based on mid-2017 estimates from the United Nations Population Division. Internet penetration rates (except for Cameroon, Kenya, and Nigeria) are from the International Telecommunication Union’s World ICT Indicators database, accessed October 2017. Cameroon penetration rate from Internet World Stats; Kenya penetration rate from Freedom House’s Freedom on the Net 2016 report, Nigeria penetration rates sourced from the national regulator. Technological readiness score from the World Economic Forum’s Global Competitiveness Report 2017. Facebook users are those who logged into their account at least once in the 30 days preceding the measurement, as reported by Facebook to Internet World Stats.

However, as noted in a 2016 study commissioned by the Internet Society10, content infrastructure in Africa requires significant development. This infrastructure includes data centers to house routers and servers, and hosting providers to host the content, along with Content Delivery Networks (CDNs) that use data centers to distribute their customers’ content to Internet Service Providers (ISPs).

In the meantime, there is a notable difference between access infrastructure and content infrastructure. While access infrastructure — such as mobile broadband networks — must be built in the country to enable access, content can be accessed from overseas data centers, notably in Europe or North America. While this is not ideal, it does provide for access to the infrastructure needed to develop the Internet economy in Africa, as demand for regional content infrastructure grows and starts to be fulfilled.

However, content and services that are hosted locally are quicker and cheaper to download, because they do not have to pass through often congested and costly international connections.11 Ultimately, it is clear that local content infrastructure must be developed in order to support a robust Internet economy across Africa.

Platforms

Internet platforms are beginning to emerge in Africa, which is encouraging for the growth of the Internet economy. For the purposes of this report, we use the broadest possible definition of a platform, as a foundation for new online services and applications to emerge. In this light, we look at the following platforms:

- Mobile money is not just important for providing efficient payments, but can also act as a platform supporting an entire ecosystem of financial and transactional services across the economy;

- Innovation hubs are becoming the basis for significant entrepreneurial activity across Africa, and in addition to helping to develop new companies, these hubs also act as an ecosystem for other entrepreneurial inputs, including venture capital funds;

- Employment platforms help to match employers with employees, for both full-time employment opportunities as well as smaller tasks, and some of these also play a part in helping to train employees to match opportunities;

- ICT platforms are a critical input for online services, by helping host, deliver, and monetize content and services; and

- Finally, online platforms are emerging to help facilitate the provision of online services; we focus on several platforms that help e-commerce companies.

Here we examine examples of each of these types of platforms — in the next sections we look at the services that are emerging, many of which leverage on these or similar platforms.

Mobile money: Historically, the first, and perhaps best known of the new innovative services in Africa is M-Pesa, a mobile money service launched in Kenya and now operating in 10 countries worldwide. It was introduced in 2007 by Vodafone with support from the UK Department for International Development (DFID), and conceived as a way to build on the then emerging practice in some countries of using airtime as a means of money transfer.12Today it is used by 29.5 million people, and recent numbers show 614 million transactions per month across Africa. In Kenya alone, M-Pesa users transacted US$28 billion in 2015. This was equivalent to 44% of the country’s GDP of US$63.4 billion at the end of 2015.13

It should be noted that until very recently, M-Pesa was not an Internet service. In 2015, Vodafone introduced M-Pesa capabilities into the dedicated app M-Pesa Wallet in some markets, enabling Android and iOS users to use M-Pesa from their smartphones.14 But it was not until March 2017 that M-Pesa was integrated into the apps of local Vodafone subsidiaries, such as the more popular mySafaricom app.

Prior to this, M-Pesa was only available using text-like messages applicable with feature phones, given the slow penetration of smartphone and slower connectivity. With the new app, Internet-based features have been added — now the app makes it easier for senders to search and confirm the identity of the recipient of the payment before sending money. As more users in Kenya and elsewhere in Africa move to smartphones, we expect more M-Pesa usage to migrate to the Internet-connected apps.It should be noted that until very recently, M-Pesa was not an Internet service. In 2015, Vodafone introduced M-Pesa capabilities into the dedicated app M-Pesa Wallet in some markets, enabling Android and iOS users to use M-Pesa from their smartphones.14 But it was not until March 2017 that M-Pesa was integrated into the apps of local Vodafone subsidiaries, such as the more popular mySafaricom app.

Although it did not start as an Internet service, M-Pesa was an early and valuable demonstration of the ability of mobile services to leapfrog traditional services. M-Pesa leveraged technology to provide the otherwise ‘unbanked’ with a form of electronic payment.15 It paved the way for other small-value electronic payment services in Africa, though the success of M-Pesa has led to increased regulatory scrutiny and commercial clashes in subsequent countries.16

In Kenya, many innovative services have been built on top of M-Pesa. These include:

- Banks have added on bank accounts, to allow savings and loans, using M-Pesa for transfers.17

- Another company has developed KopoKopo, a mobile app that enables merchant payments, allowing small businesses to accept payments from M-Pesa accounts.

- Another innovation is M-Kopa Solar, which allows people to buy solar panels with installments paid through M-Pesa. These, in turn, can help solve the challenge of charging devices in areas where there is not yet an electrical grid.

- In March 2017 Kenya introduced the first mobile money government bond, called M-Akiba, which can be purchased with M-Pesa (or the similar Airtel Money service). It is aimed at increasing savings and citizen participation in government infrastructure development.18

- M-Pesa offers international money transfers, allowing the African diaspora abroad to send money to family in Kenya, Rwanda, Tanzania, and Uganda.19

As a result, M-Pesa has enabled a financial ecosystem allowing individuals to be able to receive money, make payments, save and borrow, and have a solar panel, among other innovations. It has become a showcase and symbol for innovative ideas and the power of mobile connectivity in Africa. Indeed, in September 2016, Facebook founder Mark Zuckerberg visited Nairobi to learn more about mobile money and to meet entrepreneurs working with it, such as Twiga Foods (described below).20

Innovation hubs: The next platform innovation was the opening of the tech innovation space, iHub, in Kenya in 2010. iHub is the locus of much entrepreneurial activity in Africa, drawing in entrepreneurs from Ghana, Nigeria, and Uganda, as well as Kenya.21 It has over 16,000 members, 170 startups, and is 70% self-funded through its research and consulting arms.22 Today, the World Bank has counted 117 innovation hubs in Africa, with a number of countries having multiple versions.23

An entire entrepreneurial ecosystem is emerging across Africa.24 This includes critical access to funding, which ranges from early stage funding, including the Savannah Fund, through to seed funding, and to later stage funding from companies including East Africa Capital Partners. More broadly, support for entrepreneurs comes from the funding platform Venture Capital for Africa (VC4A), the African Technology Foundation which provides entrepreneurs with tools and international connections, the showcase for innovative startups DEMO Africa, and Mara Mentor which links women and young entrepreneurs with experienced mentors.

“JUST LANDED IN NAIROBI! I’m here to meet with entrepreneurs and developers, and to learn about mobile money — where Kenya is the world leader. I’m starting at a place called iHub, where entrepreneurs can build and prototype their ideas. Two of the engineers I met — Fausto and Mark — designed a system to help people use mobile payments to buy small amounts of cooking gas, which is a lot safer and better for the environment than charcoal or kerosene. It’s inspiring to see how engineers here are using mobile money to build businesses and help their community. ”

—Mark Zuckerberg, Facebook post from Nairobi, 1 September 2016

Employment platforms: Local platforms are emerging to help match employees with employers for both full time and freelance work. 1task1job is a freelancing platform in Cameroon, which allows Cameroonians living abroad to hire workers in Cameroon to complete tasks. Jobberman, a large platform in Nigeria, was started by three university students, and describes itself as a leading provider of viable solutions to unemployment. It has become the top choice for both jobseekers and job providers. HyperionDev is an online coding bootcamp that offers “microdegrees” with mentor support and job interview preparation, with a view to matching students with entry-level software development jobs in South Africa.Foundation which provides entrepreneurs with tools and international connections, the showcase for innovative startups DEMO Africa, and Mara Mentor which links women and young entrepreneurs with experienced mentors.

ICT platforms: Another set of platforms are emerging to help deliver and monetize content throughout Africa. At the content level, KOOBA, in Kenya, is a new carrier-neutral data center in East Africa, joining ones in Nigeria and South Africa to host and deliver content locally, with savings in latency and cost. Angani and a few other companies are early regional Content Delivery Networks (CDNs), managing the distribution of content. To help provide and monetize content, the MTN Group offers the MTNPlay app store in 22 countries where it offers mobile services. Instabug in Egypt manages bug bounty programs for 26 of the Fortune 100. If you identify a new bug or vulnerability in a major app or website, you notify Instabug, who upon verifying it, pays a reward and has the vulnerability patched. Finally, mi-Fone is a mobile device developer and manufacturer based in Mauritius.

Emerging platforms: A set of platforms are emerging to support e-commerce companies. In Nigeria, for instance, Africa Courier Express provides logistics to deliver goods from retailers to customers. CowTribe connects Ghanaians with an on-demand veterinary service that allows farmers to get help for sick cows, sheep, and goats through an app. Kenya’s Flare calls itself “Uber for ambulances and emergency care” — an app that aggregates privately owned ambulance companies into an interface for patients and hospitals when crisis strikes. Okhtub, based in Egypt, is a matchmaking platform that provides life partner recommendations and marriage counseling services, designed to be accepted by local cultures. BuyPower allows Nigerian consumers to purchase small units of electricity through an app, rather than having to queue at a kiosk. Kangpe, based in Nigeria, connects patients with doctors, allowing them to obtain medical advice through webcam. Finally, AdsBrook in Ghana is an African-focused digital advertising network to pair advertisers with relevant websites and mobile apps.

E-learning platforms: Entrepreneurs are seeking to use the Internet to address the lack of access to, and sometimes poor quality of education in the region, with a number of platforms emerging to develop the continent’s education infrastructure. These include the Nigerian tool Tutor.ng, which teaches adults skills such as reading, spelling, history, science, and the creative arts. Another, the South African platform Obami, describes itself as a “digital learning intervention”, harnessing the power of algorithms to tailor online course content in everything from childcare to positive mindfulness and the rules of Creative Commons licenses, to best fit the needs of the learner. Rekindle Learning in South Africa is an adaptive learning tool built on a mobile platform, whose founder, Rapelang Rabana, has been recognized as a top young entrepreneur in Africa.25

Fin-tech Platforms: Aella based in Nigeria, aims to bring faster access to loans to the 435 million Africans with limited credit resources. Its algorithm for identifying creditworthy borrowers has attracted significant interest from financial institutions in the US and Europe. In the fintech community, this is a very hot startup. Asaak, based in Uganda, seeks to expand access to financial services and insurance in East Africa for those with little access to capital. Borrowers who have repaid multiple micro-loans are able to step in as guarantors to new users, potentially earning a share of the interest from these loans as they are repaid (though their own capital is at risk).

Internet Economy

These new platforms and the ecosystems that have emerged, along with the entrepreneurial energy that has propelled them, support a number of new and innovative services that point the way towards the development of an Internet economy. These are largely websites and mobile apps that sit on top of the Internet and enable organizations to increase their efficiency and the reach of their operations.

B2C services A number of B2C services have emerged in Africa, serving local needs. These include entertainment, commerce, and sharing apps. We highlight a few here that have been rewarded with funding and growth.

- OMG Digital (Ghana) is a hyper-local media content publisher aimed at African millennials. It covers three countries (Ghana, Kenya, and Nigeria), delivering pop culture, entertainment, and lifestyle news to 4.5 million unique visitors per month. It has plans to expand its coverage and readership into the South African, Zambian, Ugandan, and Tanzanian markets over the coming year. OMG Digital is the only media start-up to have been funded by the platinum-tier Silicon Valley accelerator Y-Combinator, aside from the magazine The Atlantic.

- SafeMotos (Rwanda) is a ridesharing app for Android and iOS, tracking how well motorcycle taxis drive, then matching the safer drivers with passengers. Early stage investor SOSV incubated SafeMotos in March 2015.26 The Economist described SafeMotos as “more than just an Uber clone” and has said its road safety initiatives are reducing traffic accidents in Rwanda. 27

- iROKO Partners (Nigeria) runs video and music streaming services in sub-Saharan Africa. It launched as a YouTubelike website in 2011, but has since switched to a Netflixlike subscription strategy where subscribers pay a monthly fee to consume unlimited content. 28 iROKO optimizes its video streaming app to work on devices that sell for less than US$40. It has secured US$8 million in capital from Tiger Global Management, and $19 million from investors including France’s Canal Plus.29

- Jumia (Nigeria) was founded as an online shopping mall, but has since expanded into the Jumia Group that consists of an ecosystem of online marketplaces. 30 Jumia has secured total equity funding of US$211 million from eight investors, including Goldman Sachs, Rocket Internet, and Orange.31 Jumia was recently celebrated as the first African ‘unicorn’ — a private startup worth over US$1 billion.32

- ZayRide (Ethiopia) is an on-demand taxi hailing app for Android and iOS that works together with taxi companies and licensed taxi drivers to connect them with riders.33 ZayRide is trying to gain ground before foreign ride sharing apps like Uber arrive.>34 Ethiopia’s state-owned banks are skeptical of lending to tech companies, as the country has an Internet penetration rate of 8%, which has left ZayRide trying to self-fund its development through crowdfunding campaigns. It’s most recent campaign sought to raise US$100,000, but it unfortunately fell short of that goal.35

“THE MAIN REASON MARKETS DO NOT WORK HERE is because there lacks a proper market infrastructure to support the 5 million population in Nairobi. As a result, produce goes bad and there are massive delays at the markets. This means that the cost of the same gets passed to the customer. The cost of a banana in Nairobi which has come from Meru or Taveta is the same as the price of a banana in London, which has come from Guatemala. This fundamental flaw points to an inefficiency that only technology can solve. ”

— Article quoting Grant Brooke, founder Twiga Foods

B2B services New B2B services are emerging in Africa; some focused on local or regional needs, others orientating towards a more global market. These services are critical, both for their own sake as valuable startups, but also for helping to bring the entire economy online. Again, we highlight some notable examples:

- Twiga Foods (Kenya) is a mobile-based B2B supply platform that enables informal vendors to order stock from Kenyan farmers, which will then be delivered the next day to urban markets and kiosks.36 Twiga Foods raised US$10.3 million in a Series A round in July 2017, and a US$2 million grant that same month from USAID to deliver financial inclusion programs to farmers.37

- Kudobuzz (Ghana) is an application that enables companies to feature positive recommendations of their products and services from various social channels on their website.39 It was incubated at the Meltwater Entrepreneurial School of Technology and has scaled without outside investment.40

- BenBen (Ghana) is a blockchain-powered land management service for prospective property owners, land developers, and financial institutions. It promotes transparent land resource management and trusted information.41 It was incubated by the fin-tech focused Barclays Accelerator in 2016.42

- Esaja.com (Zimbabwe) is an online business directory that provides information on businesses across the continent, aiming to use technology to bridge borders and to create an African marketplace for goods and services.43 The company has received seed funding from CRE Venture Capital.44

Such B2B online services bring the efficiency and reach of the Internet to more traditional enterprises that make up a large part of every country’s economy. However, not all companies are online, and not all online companies are ready to fully capitalize on these services, an issue we address further below.

E-Agriculture As a case study, e-agriculture provides an interesting intersection between one of the oldest human activities and one of the newest. The benefits include providing information about inputs such as seeds and pesticides, helping to increase productivity, and providing more information about markets to help farmers to negotiate the best prices for their output. Given the unique local nature of agricultural markets, local developers are likely best placed to identify and fill these needs.

THE EMERGING TREND IN KENYA has shown that well educated and skillful youth are turning to agriculture to earn a living. They target niche markets to start ventures where produce moves quickly. The majority of youthful farmers own modern phones and spend considerable time on the Internet, reading about the animals they keep or the crops they grow, following market and farming trends. These digital youth advertise their products through Facebook by posting product photographs, indicating their offer price and giving the location. Product demand calls immediately start coming in.

—Kenya Agricultural Research Institute 54

Agriculture is one of the most important sectors for Africa, employing 70% of workers and generating 30% of GDP.45 The examples below highlight how local people are often best able to address local needs in this vital sector.

- Esoko (Ghana) is an online platform to help small hold farmers gather information about market prices, weather, and other tips to increase their revenues. It now serves three countries and 500,000 farmers. According to one study, it enabled small farmers of maize to increase their revenues by 10%.46

- iCow (Kenya) is an agricultural information service that seeks to make African farmers more prosperous by offering them easy access to relevant information about cattle rearing.47 The company was incubated by Nairobi’s iHub and the Appfrica Fund, and now has operations in Ethiopia, Kenya, and Tanzania.48

- Tech4farmers (Uganda) is a commodity exchange and warehouse receipting system that promotes transparency throughout the entire value chain for farmers, warehouse operators, good processors, financial service providers, and transporters.49 Tech4farmers was incubated by Thomson Reuters and the Barclays Accelerator in Cape Town.50

- Farm Fresh (Gambia) is an e-commerce platform that has formed partnerships with small hold farmers so they can sell their products online.51 It is the first online shopping and delivery platform with fresh produce in the country.52

There is growing evidence that these new services are not only helping farmers, but can transform the sector, particularly drawing in younger farmers who see agriculture as a more high-tech sector because of this new wave of technological innovations.53

E-government E-government services enable governments to improve the delivery of services to citizens while increasing their efficiency. One comprehensive example is the recently introduced Irembo online portal in Rwanda. Irembo currently offers 50 services, across a number of government agencies, and is set to expand to 100 services by the end of 2017.55 These services cover applications for birth certificates, driving license registration, and online visa payments for visitors. The service leverages partnerships and existing services in a number of ways:

- The platform itself was developed by a private company, Rwanda Online Platform Limited, in a publicprivate partnership.

- In order to facilitate domestic payments, the government has partnered with the local mobile payments provider Tigo Cash, provided by the Tigo Rwanda mobile operator.

- There is a partnership with MasterCard to allow for payments from citizens for domestic services (and foreigners for entry visas), and the Bank of Kigali which can extend payment opportunities to merchants in Rwanda.56

- To ensure access for all, the Rwanda Telecentre Network is training the telecenter managers with skills to enable citizens to access the Irembo platform.

- The government has hired 1,500 Internet cafés to extend Irembo access to people who do not own or have access to a smartphone.57

Another prominent example is the Huduma Kenya Program, launched in 2013 to improve the delivery of government services to Kenyan citizens. In addition to 33 in-person centers scattered around the country for those without access to an Internet-connected device, there is a web portal optimized for both mobile devices and laptops, and an online payment gateway. It offers access to 55 government services, and is used by over 30,000 citizens every day.58

E-government services are important for a number of reasons. They help deliver services, and they promote demand in vital ways. Firstly, e-government services provide a reason for citizens to go online, and thereby experiencing first-hand the benefits that the Internet can deliver. Secondly, e-government services can create demand for Internet infrastructure and services that promote the growth of the local Internet sector, which can then extend to service other businesses.

Social services Finally, innovative new services are emerging to provide social services, which meet the needs of citizens and often complement government services in areas such as education, transportation, and health care.

- Asoriba (Ghana) is a cloud-based church management tool which connects churchgoers with their church digitally.59 It allows church members to pay their tithes online and to receive daily devotionals even when unable to physically attend a church. Asoriba was chosen for Barclays Accelerator in Cape Town in 2016.60

- ClaimSync (Ghana) is a platform for healthcare providers that assists them in preparing and sending medical claims to health insurance companies.61 It allows for efficient patient record management, reduces the processing time for claims, and improves clinic security.62

- Jamii (Tanzania) is a micro-health insurance service aiming to bring healthcare within reach of the 50 million people in Tanzania with no access to it.63 Jamii claims to have reduced insurance overheads in the country by 95%, allowing it offer health insurance for US$1 per month. The company has received funding from the Bill and Melinda Gates Foundation.64

- ConnectMed (South Africa) connects patients with licensed medical practitioners over online video links. This increases access to healthcare for patients in remote areas, allows others to avoid traffic in urban areas, and provides flexibility for both doctors and patients. It has recently expanded into Kenya.65

These and many other organizations are helping to deliver vital social services, leveraging the power of the Internet to help improve the lives of millions across Africa.

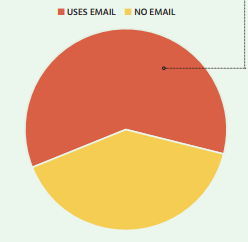

2 IN 5 AFRICAN BUSINESSES DO NOT USE EMAIL

BUSINESS USE OF EMAIL. Research from the World Bank reveals that just over 60 percent of surveyed companies in sub-Saharan Africa use email to interact with clients or suppliers. This is fairly high, but below the global average of 72%.

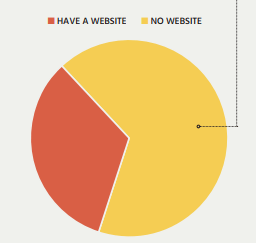

ONLY 1 IN 3 AFRICAN BUSINESSES HAVE A WEBSITE

BUSINESSES WITH WEBSITES. The World Bank queried businesses as to whether they have a website. More than two-thirds of companies in sub-Saharan Africa do not have a website.

Progress towards an Internet Economy in Africa

The progress of the Internet economy in Africa is difficult to measure, relying mainly on anecdotal evidence of the emergence and impact of services. While the examples highlighted above are impressive, they should not be taken to indicate that all the pieces are in place for a transformation of economies in Africa; rather, they should be taken as an indication of what can happen when the appropriate inputs become available.

Internet Sector

While Internet availability and access has been growing across Africa, connectivity is by no means universal. The ITU World Telecommunication/ICT Indicators 2017 reveal that an average of only 21.8% of individuals are online in Africa. This leaves significant work to be done to bring more people online. Furthermore, the advances in adoption are quite uneven, ranging from as low as 1.1% in Eritrea and 1.8% in Somalia, through to 55% in Morocco, 47% in the Seychelles, and 41% in South Africa.66 Efforts to close this digital divide must be sustained in order to provide opportunity for all individuals and businesses to participate in the Internet economy.

Content infrastructure lags further behind in Africa.67 There are data centers emerging, a growing number of IXPs to exchange local traffic, along with international content providers and CDNs beginning to install nodes in Africa. However, most content, even local websites, are hosted and being delivered from Europe or the United States. As a result, upwards of 90% of traffic for African countries is international traffic rather than locally sourced. Further compounding this content gap is a gap in available data, making it difficult to fully understand trends in content hosting and international traffic other than with anecdotal data.

Internet Platforms

Sub-Saharan Africa is leading the world in the adoption of mobile money and payments. According to research from the GSMA, 140 out of 277 mobile money services are in that region, along with over 60% of active mobile money accounts, of which there were almost 120 million.

With respect to innovation, the GSMA says there are 314 active tech hubs across 42 countries in Africa, which suggests a healthy platform. However, 50% of them are in five countries — South Africa, Kenya, Nigeria, Egypt, and Morocco, of which three are in sub-Saharan Africa.68 Likewise, the GSMA noted that US$185 million had been raised by startups in Africa in 2015, of which 80% went to companies in South Africa, Kenya, and Nigeria. This suggests that innovation is concentrating in one country in each of West, South, and East Africa. Furthermore, US$185 million is small relative to the total of US$27.3 billion invested in startups worldwide that same year.69

While the progress of these platforms is uneven, it nevertheless provides a significant foundation for growth, as we have seen with the ecosystem building around M-Pesa in Kenya, and the new innovative companies emerging across several countries around Africa. The benefits of the underlying platforms must be recognized and nourished in order to propel the entire sector.

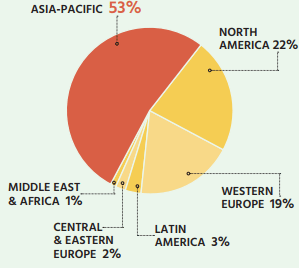

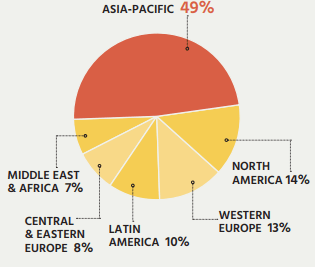

AFRICA’S SHARE OF GLOBAL E-COMMERCE IS NEGLIBLE: LESS THAN 1%

E-COMMERCE. The level of retail (B2C) e-commerce in Africa is very low. Even including the Middle East, the region’s share of global e-commerce was less than 1% in 2015.

AFRICANS ARE ALREADY SHOPPING ONLINE — THEY ARE JUST BUYING FROM OUTSIDE OF AFRICA

THE E-COMMERCE PICTURE is slightly better with respect to the number of online shoppers, for which the region represents over 7% of global consumers. This suggests that there is interest in online shopping.70

Internet Economy

Data shows that the development of the Internet economy in Africa is in its early stages.

This data highlights that there is still significant work to be done to create an Internet economy in Africa. Using email and having a website is an important first step for online engagement for a business, but it is only the first step towards entering the global Internet economy. Furthermore, in terms of e-commerce — an early indicator of online business — Africa is lagging behind other regions of the world. There are still significant roadblocks to be overcome before Africa can realize a full Internet economy.

Roadblocks

The Internet economy must sit on the foundation of a strong Internet sector, and can be facilitated with Internet platforms that help businesses and governments to go online. In this section, we focus on the roadblocks to a strong Internet economy.

Internet sector

Most countries have mobile broadband availability far beyond adoption. While it is true that there are strong demand-side reasons for this, which will be addressed as the entire economy goes digital and provides locally relevant content and services, it is important that the Internet sector can accommodate this growth of adoption and usage. This involves ensuring adequate access and content infrastructure, and promoting the development of Internet companies offering such content and digital services. We examine these issues based on the following graph, showing availability and adoption in Rwanda.

This graph shows that mobile cellular coverage in Rwanda is essentially 100% for traditional telecommunication services such as voice, and that 88% of the country’s networks have been upgraded to provide a mobile Internet service. That said, only 26% of the population utilizes mobile Internet in Rwanda. This highlights three gaps:

Gap 1 — Availability: Where there is mobile cellular coverage, but the infrastructure has not been upgraded to distribute mobile broadband.The availability of broadband is critical for both the application/ content provider and for their users. Particularly in the case of government services, it is important that all citizens universally have access to Internet services for maximum adoption, usage, and fairness in the provision of access to government offerings. Increased availability of broadband may involve upgrading 2G networks. The cost of doing this is much lower than the cost of deploying the original networks, and can largely be driven by increases in demand.

In some countries, there is a further gap in that the mobile cellular network does not cover all citizens. This gap does not exist in the case of Rwanda, but for Africa as a whole, the gap averages 11%. Building out the network to these uncovered areas is not typically economical, based on high deployment costs or low revenue potential, and will require turning to new solutions such as community networks, and direct government investments or partnerships.

Among other inputs, network availability requires backhaul to connect to the rest of the network and the Internet. This itself can be quite expensive, particularly in remote areas of a country where costs of deployment may be high (based on geographical challenges) and returns may be low (based on low population density). More broadly, there are 16 landlocked countries in Africa, which must further rely on terrestrial networks to access international Internet transit capacity at submarine cable landing stations in neighboring coastal countries.71

A final gap relates to the availability of electrical power, which is critical both for operators’ equipment to run the network, and for users to be able to charge their devices. A significant 76% of the population in sub-Saharan Africa lacks access to electricity.72 Energy poverty is an acknowledged hindrance to the growth of the Internet economy in Africa.

If electrical power is not available, then diesel generators are required to run the equipment, which increases capital and operating expenses. If electrical power is available, but not reliable, generators are still required. For users who do not have direct access to power, they may need to pay to charge their devices at a kiosk, or require access to a solarpowered generator. This adds cost and barriers to accessing the Internet.

Gap 2 — Adoption: Where there are potential users who have access to broadband, but have not yet chosen to adopt it.

This is a demand-side issue that can be addressed by making access more affordable and attractive.

Affordability. The cost of access is very important. As noted by the UN Broadband Commission and research by the Alliance for Affordable Internet (A4AI), access that costs greater than 5% of average monthly income is unaffordable and thereby reduces both access and usage. In their 2017 Affordability Report, the A4AI highlighted this affordability issue and put forward a number of solutions. They showed that in Africa, affordability has been improving, but the cost of 1GB of mobile prepaid data still costs an average of 17.49% of Gross National Income per capita across the continent. This is a far cry from the 5% target, which A4AI further advocates should be reduced to 2% to be more realistic for households.73

The cost of business access may be even higher for several reasons. Firstly, businesses may need faster access than individuals. Secondly, they may generate more traffic, which increases the cost. Thirdly, businesses may need more than a smartphone to run their business. For instance, a computer with a larger monitor and keyboard to facilitate business tasks such as word processing or email exchange.

Content and services. To increase demand, there needs to be new, locally relevant content and services. Content and services are relevant when they meet local demand, in local languages. This requires infrastructure to host the content, strong content policies to provide certainty about how online content is regulated (if at all), and policies to assist creatives who can develop this content.

Local content infrastructure is important because hosting content locally makes the pages load faster, which, as shown in a recent Internet Society study in Rwanda, in turn leads to increased usage of the website.74 This becomes more and more important as organizations begin to conduct more business online, and host richer and more dynamic content, which can be used to maximize the engagement of their users.

Skills need to be developed. A lack of knowledge as to how to use the Internet can be a significant barrier to its adoption. This is true for individuals, who need to know how to use their phone to access content and apps, and is likely also true for businesses, as employees may need additional skills and training to generate a meaningful return from their use of the Internet. Upskilling in areas such as website development, best practices in online buying or selling, and in analyzing users’ online behavior, is likely to be needed.

Gap 3 — Usage: Quality access to the Internet is essential for the Internet to be used.

Bandwidth needs to be available for the Internet to be used to its full potential. Particularly for interactive or video-based services, the bandwidth required for fast and reliable access is more than what was previously required for text-based services. Bandwidth must be available not just at the last mile, but also in national and international connectivity. There has been a significant increase in international submarine connectivity around Africa in recent years, however the continent’s 16 landlocked countries have not all fully benefited due to challenges in extending terrestrial backbone across borders to reach the coastal landing stations.75

In addition, new mobile technologies allow for greater capacity and download speeds. While progress has been made and the availability of 3G mobile broadband is spreading, the global movement has been towards faster, 4G networks. An increasing number of countries in Africa have 4G networks, but these tend to be in wealthier urban areas. This progress must be sustained and equitably dispersed to provide full benefits to all users.

Businesses may have usage needs beyond those of individuals. Businesses would benefit from higher speeds than those currently available through mobile networks. In particular, fiber optic networks, which are not yet widespread in Africa, may be critical for their successful utilization of the Internet. Businesses may also be more dependent on reliable service (for instance, from the electricity grid), better cybersecurity, and access to cloud services that they can use to access or develop applications to help run their businesses.

While access infrastructure is developing well in Africa, and content infrastructure is lacking in many countries, the foundation to support the Internet economy is being built. In the next section of this report we will address issues for the broader Internet economy that will help create demand for infrastructure in a virtuous circle of growth.

Internet Economy

To fully realize the benefits of the Internet and become a part of the global economy requires a fully digital domestic economy. This entails bringing online all citizens, all companies — both traditional ones and emerging, high-tech ones — as well as e-government services capable of efficiently delivering government services.

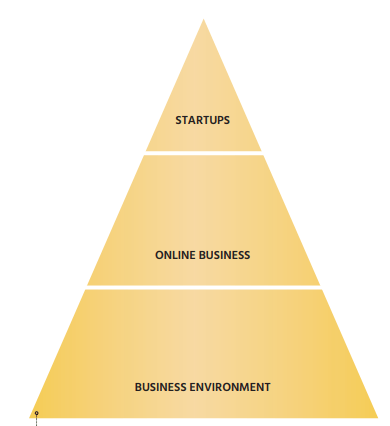

In this report, we have detailed impressive successes across a variety of sectors. Based on these stories, we note there should be a focus on creating local platforms, upon which other services and even entire ecosystems can grow. Fostering innovation and entrepreneurship is one means of filling these gaps. In order to do so, there are a number of challenges impeding the development of an Internet economy in Africa. These challenges can broadly be grouped into three levels, as visualized in the figure on page 21.

The base set of challenges are those that face any business in any sector. These must be addressed for all companies in a country. The second set of challenges are those impacting online companies, and relate both to the offering of an online service and the demand for the service. These could impact traditional companies as well as startups. The final set, at the top of the pyramid, are those challenges that impact online startups, which potentially represent a large source of innovation in the Internet economy.

We will examine each layer in turn.

Business Environment. General challenges to doing business have been widely noted and studied. For instance, the World Bank has a yearly index called Doing Business that ranks most countries based on a number of metrics. Some are not generally relevant here, such as the challenge of dealing with construction permits, while others are very relevant. These include paying taxes (including time and total tax rate), getting electricity (including the time to get connected to the grid, cost, and reliability), getting credit, and trading across borders (time and cost to export and import goods). At least one metric, starting a business, is geared specifically towards startups.

While not at the core of this report, these issues are at the core of building a robust economy, digital or otherwise. The rule of law is key to promoting investment, to ensuring that there is enforcement and certainty, both in the course of business and in the case of disputes. An important element is the level of corruption, which can raise the cost of doing business, add uncertainty about outcomes of bidding processes and even judicial disputes. The fight against corruption has often been noted as key to the dizzying growth of Singapore since independence, for instance.76

Online Business. The second set of challenges relates to any company that is online. These companies need access to the Internet to offer services, but also need their customers — whether other businesses, consumers, or government — to be online to access their services. Part of this relates to having access to relevant infrastructure, as detailed above, but it also has to do with issues that are particular to online services. These include:

- CONTENT POLICY: Policies regarding applications, content, and services can have a significant impact on the availability of innovation and investment.

- Blocking or filtering. Policies that restrict content, based on political, cultural, or other reasons, typically migrate from offline to online environments. These policies can serve to restrict content and lead to self-censorship of companies developing their own content, with corresponding restrictions on the ability to conduct business. Uncertainty on the application of policies can also impact development and investment.77

- Intermediary liability. Intermediary platforms that host content from others (such as Facebook and YouTube) cannot screen all content that is uploaded before it is made available to users to view. If they are made liable for all uploaded content, it raises their cost of doing business and risk of operating in particular markets, and would likely limit investment and the development of local or competing platforms.

- Shutdowns. On occasions, certain countries will intentionally disrupt the Internet so that it becomes unusable either within a specific geographic area or to a certain segment of the population. This has a material economic impact, hindering productivity, adversely impacting business confidence, and is detrimental to foreign investment. At a global level, a recent study showed that one year’s worth of artificial shutdowns cost the global economy USD 2.4 billion.80

- DATA POLICIES. Many online services gather personal information in order to deliver their services. The information collected can be financial, related to healthcare, reveal one’s location, gender, or ethnicity, or otherwise be sensitive. Policies with respect to privacy and security may have a significant impact on an online business.

- Privacy. Data protection and privacy laws typically address the collection, storage, and transfer of personal information. Unprotected storage and sharing of such data creates risk of identity theft, fraud, and numerous economic and even national security risks. Such data may also be used for unwanted commercial approaches and spam, for discriminatory purposes based on race, religion, gender, or sexual orientation, or for other problematic or unlawful purposes. Personal data needs to be protected from accidental destruction, loss, alteration, and unauthorized disclosure or access. In the absence of national privacy laws, the OECD Guidelines on the Protection of Privacy and Transborder Flows of Personal Data are seen to represent a global consensus on the basic principles of how and when data can be collected and disclosed.81

- Security. Data breaches can have a significant impact on a business, in terms of costs, lost business, and sometimes, a loss of competitive advantage. While any holder of personal information, be that government or private sector, should ensure the use of appropriate tools and the development of a strategy for data security to prevent breaches, clear and effective government policy can help guide companies and increase the incentives to avoid a breach.82

- Law enforcement and security. There are legitimate law enforcement needs for access to information, and good rules can help a country balance a citizen’s rights to privacy with legal and national security concerns. The resulting surveillance regime can respect legitimate privacy expectations.

- IDENTITY. Proof of identity is necessary to access a number of services such as healthcare, education and financial services, but the World Bank estimates that more than 1.5 billion people do not have access to formal identification — and this is particularly true in Africa.83 Countries without identity systems can leapfrog to digital identity services, while others can migrate and enable their citizens access to a wide range of online services.84

- MONETIZATION. Online businesses need a way to collect income for their services. Traditional companies that charge for their services or goods offline must be able to do so online. Traditional media, as well as other online companies, have found other sources of revenue including advertising. In many countries in Africa, the main sources of monetization still offer challenges.

- App stores are a very easy way to sell digital content and applications, but in Nigeria the largest app store, Google Play, only allows Nigerian developers to sell apps through the store (in other countries Google Play allows for in-app purchases).In some countries, the only option is to offer free apps; in others still, even that is not possible. While there are African app stores and they can help to develop markets, they do not yet have the global reach of the other larger app stores.85

- For websites, advertising is a common form of monetization as it enables the website to be available at no cost to the end-user. However, the largest ad platforms such as Google AdSense do not accept ads in any African languages aside from Arabic, English, French, and Portuguese.86 This reduces the potential to monetize new services, particularly domestically and within the region, and is a gap that local advertising channels cannot fully fill yet.

- E-commerce. Despite significant advances in mobile money systems such as M-Pesa, many e-commerce providers must rely on cash-on-delivery for payments. This adds significant risks which must be borne by the business, which include robberies, costs in handling cash, and a high return rate as customers turn away deliveries for which they have not yet paid.87

- SKILLS. Literacy is an important element for going online, and digital literacy skills are needed to make users comfortable once connected. Where surveys have been taken, many nonusers cite a lack of skills as a leading reason for not utilizing the Internet, while those online may use more services with more online training. At the same time, to create online services, providing access and content infrastructure, and other critical inputs also requires training, which will increase the competitiveness of these local services.

- STARTUPS. The third challenge is specific to online startups. Despite the significant set of inputs described in this report, including the establishment of innovation hubs and increased venture capital which has led to a wide array of innovative companies and services, there is still work to be done. There are two key challenges:

- Venture capital. A traditional source of funding for startups is still largely lacking in Africa. According to one source, looking at a sample of startup investments across Africa, venture capital funding represents 3% of investments, just ahead of donations, while the main source is funding from the founder. This is a significant impediment as many wouldbe entrepreneurs do not necessarily have their own funds. The good news is that several Silicon Valley incubators are now actively searching for African companies to support, with both know-how and investment.

- Skills. Online entrepreneurs must combine both the technical skills necessary to turn an idea into an innovation, and the business skills necessary to turn the innovation into an income stream. These skills can be encompassed by an individual or a team, and are often aided by outside mentorship. The innovation hubs across Africa can be ideal meeting points to bring together the necessary inputs, however they are not necessarily scalable. Education, therefore, plays a big role in training would-be entrepreneurs.

These roadblocks not only hinder the development of the Internet sector, but also the adoption of the Internet more broadly to develop the Internet economy. Our recommendations seek to develop both.

Recommendations

Overall, our recommendations track the challenges identified in this report. Broadly speaking, policy should focus on continuing to grow the Internet sector, while also including steps to make the rest of the economy digital, including supporting critical Internet platforms. It is important to note top-down policy is vital to generate the enabling environment, but the Internet economy will develop, innovate, and thrive from the bottom up once the appropriate tools and frameworks are in place.

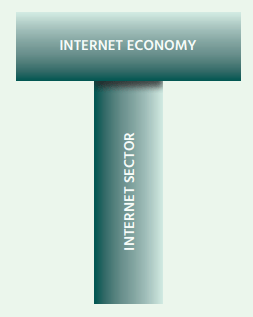

Achieving this broad framework requires ‘T-shaped’ Internet policy. This is a metaphor the Internet Society has developed to advocate for targeted depth with overall breadth. The vertical bar on the T represents the depth in Internet sector policy that must be created. That is, in order to support the adoption and usage of the Internet, there must first be in place the necessary infrastructure, expertise, and capabilities. The horizontal bar is more interdisciplinary; it involves upskilling to create breadth across government to support bringing everyone online. After all, it is only when all people, businesses, and government agencies are using the Internet that the benefits can be fully realized.

‘T-SHAPED’ INTERNET POLICY

Developing the Internet sector has, at least within Africa, traditionally been seen as within the purview of the Ministry of Information and Communication Technology (ICT) or a telecommunications regulator, with the typical focus being on developing Internet access infrastructure. This has generally been successful, as Internet availability largely outpaces adoption in many countries. However, in order to develop the broader Internet economy, there will need to be a sustained push among all parts of government to develop the platforms Many of these actions will also help to bring the benefits of required. It can no longer be the job of the Ministry of ICT alone.

Internet sector

With respect to developing the Internet sector, the set of recommendations are generally well understood, but worth repeating.89

Often countries focus their goals for the Internet sector on national broadband plans, or more broadly, on digital Many needed policies are self-reinforcing. Creating a development strategies that focus on developing content strong Internet sector in an economy requires a focus on and services as well as networks. These efforts can be sector access and content infrastructure. It requires fostering specific and benefit from the support from the highest levels a welcoming business environment for the companies of government.90 See the box below with details regarding in the sector, both offering access and services; and it Rwanda’s digital development strategy.

Many of these actions will also help to bring the benefits of the Internet to the rest of the economy. By increasing access to the Internet across the economy, more companies will be willing to go online. However, as we already see today, it is not enough to have Internet access available, there must also be demand. That demand must come not just from individuals, but also from organizations, be they companies, governments, or non-profits.

Many needed policies are self-reinforcing. Creating a strong Internet sector in an economy requires a focus on access and content infrastructure. It requires fostering a welcoming business environment for the companies in the sector, both offering access and services; and it requires a startup economy able to develop and incubate the startups that are critical for the development of the Internet sector. These policies then not only create an Internet sector that is the foundation for an Internet economy, they also help increase usage of the Internet

across the economy and develop new innovative companies in other sectors.

ACCESS INFRASTRUCTURE

Ensure that broadband is available, affordable, and there is sufficient bandwidth for new services. This requires several steps:

- Liberalization of the sector to promote competition. The conditions of liberalization are important, with licenses that offer flexibility, are reasonably priced, and have transparent conditions.

- Affordable taxation of mobile Internet devices and services, where they are not treated as luxury goods, and balance the need to increase usage while promoting the Internet economy.

- Removal of undue tariff and non-tariff barriers to importing the equipment needed to operate the networks, to lower the cost and uncertainty involved in deploying infrastructure.

- Accessible electricity, to enable companies to power their networks and users to power their devices. This can be achieved with a combination of sector reforms and new technologies.

- Spectrum policies that allow for sufficient allocations so that companies can use the spectrum in an efficient and flexible manner, at affordable costs.

Policy should promote private investment in access networks. For instance, removing undue restrictions on foreign direct investment in telecom operators, while also engaging a country’s investment promotion agency to encourage investment in the digital economy.

Where private investment is not likely, other approaches — including support for community networks or public investments — should be considered. These could potentially include public-private partnerships.

CONTENT INFRASTRUCTURE

Data centers can benefit from a number of factors similar to the ones detailed above, such as access to affordable and reliable sources of power, lower import taxes, and favorable investment policies. In addition, a number of other factors are important:

- Trained personnel to operate the data center, providing for reliability and security, which requires educational opportunities that can begin at universities and vocational training institutions;

- Access to international resources, often provided by Internet equipment vendors; and

- Access to multiple backbone networks provides for redundancy and resilience for the data center, making it more attractive to customers and thereby presenting a better business case for investment. This can be achieved through the promotion of access networks, described above.

Internet Economy

Of course, countries already have an Internet sector which may not be fully developed, and this can and should form the basis for the Internet economy. Within government, the Ministry responsible for ICT and the telecommunications regulator play key roles in setting the enabling environment for developing the Internet sector, particularly in relation to access and content infrastructure. However, many other parts of government can impact the adoption and usage of the Internet and the ICT technologies needed to become an Internet economy.

The result of these policies should be to create both the supply of Internet access, as well as the demand for Internet services across the economy.

A key factor may be the breadth of policies, allowing the Internet sector to impact the other sectors. An important element here would be a high-level government strategy, which extends

beyond the ICT sector to provide enabling solutions and promote broader use. This requires support from the highest levels of government, along with capacity building across the government

to support moves into new areas of the Internet economy.

BUSINESS ENVIRONMENT

- Governments must focus on the areas of the World Bank’s Doing Business report that create a platform for an Internet economy. This includes making it easier to start a business, enforce a contract, obtain credit, and or become connected to the electricity grid. In addition to creating an attractive business environment, electricity is critical to online infrastructure; credit is likewise critical to building a startup.91

- Addressing corruption is an important part of strengthening an economy.92 Moving to an Internet economy can reduce corruption through open data that provides for more transparency in general, and through moving payments online, for instance.93

ONLINE BUSINESS

- Ensure legal and policy clarity for local content developers, hosting providers, CDNs, and data centers. This can include intermediary liability protection to increase the willingness to host third party content. Policies should not unduly restrict the ability of carrier-neutral data centers to host content.94

- Data protection and privacy laws create confidence for customers that their sensitive information will be protected, and thus promote investment in online services.95

- Ensure there is a means to buy and sell services, within the country (potentially using mobile money), but also that international payments are feasible. This requires work by the finance ministry of a country to facilitate the emergence of online payments that generate trust but without undue regulations that may serve to protect vested interests.96

- Cybersecurity laws and procedures that help to create trust and deter attacks.

- Digital ID that enables access to relevant online services including financial, healthcare, and others. This first requires providing an officially recognized identity to all citizens, and at the same time creating a digital identity for widespread use while protecting privacy.97

- Education and digital skills training to ensure users can have meaningful online experiences. This can be provided through schools, at public Internet access points, and online by private or non-profit organizations.

- Skills training aimed at employees of traditional sectors so they can get online and join the Internet economy. Again, this can be provided by a wide variety of organizations, but should include government support for university courses and vocational training.

ONLINE STARTUPS

- Ensuring private venture capital can be offered, while also potentially supplementing private investment, illustrated by Israel’s experience in kickstarting the industry by providing funds to venture capital companies. In addition, governments can promote crowdfunding solutions in their country by allowing them to sell equity, rather than give loans, and ensuring international money transfers are available and affordable.99

- Where needed, support for the development and operation of an innovation hub can help to create a platform for the development of startups. Government support can be direct in establishing such a hub, such as the one in Cape Verde, or more indirect in creating an enabling environment to promote an existing innovation hub.100

- Additional skills training so users can become developers of content and services, and have access to suitable business training as well as online training. As above, this can be achieved through universities, vocational training, and through online access to international training.

As an example, Rwanda has made significant progress and consistently scored high on ICT indices such as the World Economic Forum’s Networked Readiness Index and A4AI’s Affordability Index. This is the result of a high-level, long-term, and concerted plan that began to form in 1998, as shown below.

The Rwanda roadmap encompasses governance, infrastructure, services, and capacity building, and is flexible to adapt to progress and changes in technology. The results are evident in their increased usage and growth of the sector.

The Rwandan Vision 2020 is a development plan to turn Rwanda into a middle-income country by the year 2020. The country’s goal is to become an ‘information-rich, knowledge-based’ economy. This vision starts at the top, from President Paul Kagame, dating back to the beginning of his administration which was seated in 2000.

In order to achieve its goals, a National Information Communications Infrastructure (NICI) policy was implemented in 2000, consisting of four five-year phases, as follows:

- NICI I (2000-2005): The foundation was set in this phase with the enacting of ICT laws, liberalization of the telecom sector, the establishment of the Ministry of ICT, and the establishment of the Rwanda Utilities and Regulatory Agency.

- NICI II (2006-2010): The focus in this phase was on infrastructure, including a data center, Internet Exchange Point, and a fiber backbone to connect to neighboring countries with submarine cable access.

- NICI III (2011-2015): This phase focused on services, including e-government services and the Rwanda Online platform, skills development, increased private sector participation, and cyber security defense efforts.

- NICI IV (2016-2020): This phase will build on the previous phases, implementing a Smart Rwanda masterplan that involves capacity building, big data, Internet of Things, growth of a private sector that begins to export, and the development of creative industries.

Conclusion

Many African countries have made significant progress toward creating an Internet sector, with broad sector reforms and focus on increasing broadband availability. There have been further successes within countries in developing online platforms, fostering the growth of companies to serve local demands, and increasing the incentive to go online. However, there is still much work to be done to strengthen the Internet sector and to create an Internet economy in Africa.

Policy must focus on deepening the Internet sector, to ensure all users and organizations can go online, with good quality access that is affordable and supported by online skills training. This is a means, however, to the end of creating an Internet economy that rests on top of this sector. This involves a breadth of traditional and new businesses online, supported by online government services.

This requires policy that is ‘T-shaped’, which provides depth of support for developing an Internet sector, and a breadth of support for bringing the rest of the economy online. Two areas of focus should be; online platforms that can support further online growth, ranging from mobile money services to online employment platforms; and supporting entrepreneurial efforts to allow innovative new companies to emerge. These platforms themselves can grow into entire ecosystems that propel broader economic growth.