Overview

More than 3.5 billion people use the Internet today, up from a mere 738 million in 2000, according to a new report[1] from the International Telecommunication Union (ITU). That’s about half the world’s population.

But what about the other half?

While the ITU says that most of the world’s other Internet-less users will be connected by traditional Internet service providers (ISPs), many remote and rural regions risk remaining without Internet access – unless they connect themselves. This digital divide exists even in developed Europe, where governments are pouring billions of euros into high-speed Internet networks.

Community networks can help fill the gap. Built and operated by people from within the community working together and combining their efforts, these networks complement traditional access networks.

They provide local access in areas where commercial operators do not find it economically viable to operate. Given the challenges with economic viability in underserved areas, it is crucial to build a sound business model to ensure the sustainability of these projects.

Community Networks must overcome serious regulatory, political and commercial hurdles.

Regulation is often inadequate – or inappropriate. Needed spectrum remains expensive or unavailable.

In response, the European Commission has given its support for these bottom-up projects, recognising Community Networks as one of the four main investment models for bringing Internet coverage throughout the continent Community Networks serve as the entry point to connectivity, running traffic at low speeds. As the network grows, it lays the groundwork for fast-speed connectivity.

In its Broadband Investment Guide,[2] the European Commission writes: “Projects employing this type of involvement have generally been very successful in driving the take-up rate among the end users and in building financially sustainable cases.” Although there are no reliable statistics on the number of Community Networks operating in Europe, the Commission notes that “a vibrant sector of broadband co-operatives and small private initiatives have grown up notably in the Nordic countries, the Netherlands and parts of the UK”. In the present study, we also find exciting examples emerging in Southern and Eastern Europe, and some are thriving even in urban settings, such as Berlin’s Freifunk network.

This paper looks at the challenges and opportunities involved in setting up, maintaining and expanding operations of Community Networks within the European Union (EU) and elsewhere in Europe. It draws lessons learned from a selection of projects ranging from Spain in the West to the Republic of Georgia in the East. We conclude that it is possible to build successful Community Networks, helping to overcome the digital divide and ensuring that Europe’s remotest regions such as the remote Caucasus Mountains benefit from connecting to the Internet.

CEPS gratefully acknowledges the Internet Society’s support for this research in providing both funding and data. The study was conducted in complete independence. It is based on personal interviews with officials in Brussels as well as telephone conversations with leaders of Community Networks throughout Europe. The authors take full responsibility for their conclusions.

Part I. Europe’s Connectivity Challenge

“Towards a European Gigabit Society!”

It’s a stirring rallying cry. In its 2016 Communication,[3] the European Commission declared that one of its priorities for the coming decade would be to connect households in the European Union to high-speed Internet, set the goal at 100 megabytes per second (Mbps). Since then, billions of euros have been spent to improve European connectivity, with significant results. Fixed broadband is available to 98% of Europeans, and 76% of European homes can access connections of at least 30 Mbps. Mobile 4G networks cover 84% of the EU’s population. The number of high-speed connections has shot up by 74% over the past two years.

Yet connectivity continues to vary between various members of the European Union, with many rural regions remain stuck in the slow digital line. The Nordics and Northwest Europe enjoy a high level of access to high-speed Internet, with the Netherlands and Luxembourg rated as the continent’s best-connected countries. Southern Europe lags. Bulgaria and the rest of the Balkans remain stuck in the slow lane.

If the countries of ‘wider Europe’ beyond the EU are factored into the analysis, the performance worsens. Ukraine’s Internet penetration reached a mere 63% in 2016, with only 54% of rural areas connected, according to Freedom House.[4] Georgia and the rest of the Caucasus region are even further behind, with less than half the entire population connected. “The number of Internet and mobile phone subscriptions in Georgia continues to grow, but high prices for services, inadequate infrastructure, and slow Internet speeds remain obstacles, particularly for those in rural areas or with low incomes,” writes Freedom House. “The government has said it will address these challenges during the next few years but has not outlined an exact strategy to overcome the

digital divide.”

Europe’s Digital Divide

The European Commission highlights this mixed performance in its Digital Economy and Society Index (DESI) [5]. It t compiles statistics on the five most relevant indicators of member state digital performance, namely digital connectivity, digital skills, online activity, the digitisation of businesses and digital public services. Once again, the Dutch and the Luxembourgers come out ahead and southeast Europeans comes out behind.

Connectivity is one of the five indicators considered in compiling DESI scores. Countries are classified for their connectivity, according to their efficiency in providing citizens and businesses access to the Internet in terms of 1) fixed broadband, 2) mobile broadband, 3) speed and 4) affordability. Croatia, Bulgaria and Poland recorded the lowest scores.

The Commission’s DESI figures fail in one important way: they do not consider population density. If rural areas[6] are examined, a giant gap persists with urbanised regions within the European Union. The share of households living in rural areas accessing the Internet daily stood at around 62%.

Eastern and Balkan countries perform particularly poorly. In Table 1 below, we consider the gap between urban and rural connection rates – and find Bulgaria, Romania and Greece the worst performers. In addition, according to the Eurostat report on rural areas,[7] in 2016 only 42% of rural Greeks and 33% of rural Romanians and Bulgarians connected daily. Other countries post spotty performances, too. Only half of rural households in Poland accessed the Internet on a daily basis in 2017, and the percentage decreases as one moves south.

Table 1. Internet connectivity (2017)

| Country | Cities (%) | Rural (%) | Broadband Connectivity Gap (%) |

| Bulgaria | 77 | 51 | 26 |

| Greece | 79 | 57 | 22 |

| Romania | 85 | 63 | 22 |

| Portugal | 83 | 62 | 21 |

| Lithuania | 83 | 67 | 16 |

| Cyprus | 84 | 69 | 15 |

| Hungary | 88 | 74 | 14 |

| Malta | 85 | 73 | 12 |

| France | 84 | 74 | 10 |

| Latvia | 81 | 71 | 10 |

| European Union | 88 | 79 | 9 |

| Croatia | 79 | 71 | 8 |

| Ireland | 92 | 84 | 8 |

| Italy | 83 | 75 | 8 |

| Spain | 85 | 77 | 8 |

| Poland | 81 | 74 | 7 |

| Slovenia | 86 | 79 | 7 |

| Czech Republic | 86 | 80 | 6 |

| Estonia | 91 | 85 | 6 |

| Finland | 96 | 90 | 6 |

| Slovakia | 81 | 75 | 6 |

| Sweden | 96 | 91 | 5 |

| Germany | 93 | 90 | 3 |

| Denmark | 93 | 91 | 2 |

| Iceland | 97 | 95 | 2 |

| Netherlands | 98 | 96 | 2 |

| Norway | 95 | 93 | 2 |

| Switzerland | 90 | 88 | 2 |

| Austria | 89 | 88 | 1 |

| United Kingdom | 94 | 93 | 1 |

| Belgium | 83 | 84 | -1 |

| Luxembourg | 95 | 98 | -3 |

Note: Percentage of households having access to Internet connectivity in 2017.

Source: Authors’ own elaboration based on Eurostat data.

A report from the European Court of Auditors[8] reinforces this finding. It shows that only nine member states (Slovenia, Cyprus, Estonia, Denmark, Luxembourg, Lithuania, the Netherlands, Belgium and Malta) achieved a broadband coverage in both urban and rural areas of more than 50% in June 2015.

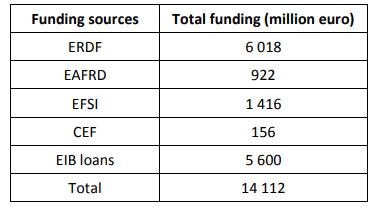

Europe’s Rapid Response

Since then, the European Commission launched its high-speed connectivity crusade, governments across the European Union have financed a massive rollout of next-generation broadband infrastructure. The funding provided from the EU budget has increased from under €3 billion for the 2007-2013 programme period to over €14 billion euro for the 2014-2020 programme period.

Free Wi-Fi hotspots are proliferating. In September, 2016, European Commission President Jean-Claude Juncker vowed “to equip every European village and every city with free wireless Internet access around the main centres of public life by 2020”. The Commission has earmarked €120 million to roll out Wi-Fi hotspots in at least 6,000 to 8,000 local communities.

National governments are spending even more to increase Internet connectivity.

Table 2. Funding sources for 2014-2020 broadband projects

Source: European Court of Auditors, Audit brief, Broadband in the EU, September 2017.

In its governing coalition agreement, the new German government committed to spend €10-€12 billion on high-speed lines. The French, Spanish and UK governments have also made strong commitments.

Despite all this public spending, it is insufficient. According to the European Commission’s Broadband Investment Guide, a total of €500 billion will be needed to meet Europe’s 2025 connectivity goals. This sum is so large that some areas are being left behind – and the gaps are often found in surprising places rather along Europe’s traditional north-south, east-west splits. In Germany, for example, East Germany is better off than West Germany, which received new wiring after the 1990 reunification. West Germany’s old industrial region of Saarland is poorly served. At the same time, rural western Spain, the Extramaduro, continues to lag behind developed areas of central Poland.

Geographical hurdles explain at least part of the gap. Italy’s mountainous terrain is expensive to connect. When a hole is dug to place fibre in Italy and Greece, it often hits an archaeological site and work has to shift to accommodate the site.

Elsewhere, construction bottlenecks are emerging. In Germany, which is pouring billions of euros into connectivity, Internet lines must be laid underground, which is difficult and expensive. Many villages wait months, even years, for upgrades to their old copper networks, or for their initial connectivity. The reason is simple: construction companies cannot find sufficient workers or machines to use all the available public money devoted to laying high-speed lines.

But connectivity doesn’t have to be expensive. Southern and East European countries such as Portugal, Spain, and Romania have less access to public investment funds but are rolling-out access to faster connectivity than in Germany, at far lower cost. This is, in part, of low labour costs, favourable regulation, and because they allow wires to be strung over ground on poles.

Connection Models

According to the European Commission’s Broadband Investment Guide, the private sector will finance 95% of the continent’s total connectivity investment. The public sector will be required to in far-flung areas where no solid business case exists. Four investment models for connectivity are practiced in Europe:[9]

- Publicly run municipal networks. The municipality, county or region builds the broadband network. While there may be a private partnership, the public authority keeps ownership of the network and runs operations. The network is then leased to private actors in a non-discriminatory way. This model is popular in the Nordic countries where a prime example is Stockholm’s fast-fibre project.

- Private municipal networks. The government procures the building and builds an open-operator neutral network, which it then outsources to private operators as a concession. This is popular in France, where the government identifies unconnected “white” spots and provides “gap funding” to private operators to cover the infrastructure rollout financial risk.

- Operator subsidies. The public authority avoids becoming directly involved, preferring to subsidise a telecommunications operator. The government funds the gap between what is commercially viable to cover those who otherwise would be left out. This is popular in Central Europe, particularly in Germany.

- Community Networks. Local residents gather together to build their own access network. Public authorities may support by supplying co-financing or providing advice and authorisations, granting rights-of-way and coordinating with other public infrastructure projects. According to the Commission judges, “projects employing this type of involvement have been very successful in driving the take-up rate among the end users and in building financially sustainable cases”.

In its study,[10] the Commission stays away from choosing or favouring one model over another. It simply says that the choice of a model depends on local conditions. But, it does say that

long-term investment models, including Community Networks, are one of the best ways to encourage continued investment to “create an engine” for improving service. Conversely, short-term models, primarily direct subsidies, favour the operator attempting to maximise return and avoid continued investment.

Unfortunately, European governments too often ignore this lesson. Only public authorities are often declared eligible to receive this public funding of Wi-Fi spots, despite an open protest[11] from the European open-Wi-Fi community. The Community Network model was not considered a viable alternative. “The explicit call to promote the economic fabric of non-profit community networks, already providing open wireless connectivity with little or no public support, was erased,” complained La Quadrature du Net, a French-led non-profit association that defends the rights and freedom of citizens on the Internet. “WIFI4EU missed the chance to promote local employment, to spread technical skills and to diversify the telecoms sector. Instead, dominant players will reap most of the WIFI4EU subsidies.”

The European Commission acknowledges this criticism. Many connectivity roll-outs may end up costing more than is necessary – and not connect the unconnected as fast as is necessary. In its Broadband study, the Commission concedes: “There is some concern that not all consumers and businesses in Europe will benefit from the gigabit society, given the current and future digital divide between urban and rural areas and across EU countries. If gigabit speeds and 5G are available only to areas with high demand, users are likely to be highly reluctant to pay for it as many new services will need continuity across borders and geographic areas.”[12]

Part II. The Community Network Solution

Community Networks represent a realistic solution to help overcome Europe’s digital divide. Under a Community Network, citizens work together, combine their resources and connect themselves to networks to meet their own communication needs. These bottom-up initiatives often grow to connect to Internet gateways or find innovative low-cost solutions. They are complementary to commercial networks, fill gaps and provide access where a strictly commercial return-on-investment metric-based logic does not justify connections.

Although most demand for Community Networks comes from the developing world, where unserved and underserved areas are endemic, experts say that a role remains for them in the developed world. According to Jan Droege, Director of the European Broadband Competence Office, “If we want universal connectivity, then we will need Community Networks to fill in the holes. Citizens must take their fate into their own hands.”

Many community networks in Europe are located in unexpected places. Citizen-owned networks operate in rural Scotland and England and in Southwest Germany. More are in Western Europe than in Eastern Europe, says Droege. All told, several hundred community networks exist worldwide, with room for more. They operate on a cost-recovery basis. Exact numbers are difficult to obtain. Most often, they are small in scope and serve communities under 2,000 residents, although, as we will see later, some networks can serve multiple neighbouring communities.

Community Networks are sprouting even in urban areas. The most prominent example is the free public WiFi networks in many German cities called Freifunk. Activist volunteers provide their wireless LAN router to other participants. Together, they set up a free internal network or use services set up by participants to chat, call or play online games. Local communities provide software adapted to their own needs and then on their websites. No money is exchanged. “It’s all volunteer,” says Gregor Bransky, a representative from the Aachen Freifunk. “We see ourselves as activists committed to democratising and decentralising the Internet.”

Freifunk activists like him most often connect to the major telecommunication companies’ backbones. “We’re not some sort of zombie apocalypse team”, Bransky says. In a few rural areas such as in the Eiffel Mountains, they have begun to build the backbone, stringing lines from church tower to church tower to create air connectivity bridges.

Funding and Regulatory Hurdles

Despite their benefits, Community Networks face a series of financial and regulatory hurdles that is difficult for a community of volunteers to navigate. Up-front investments are required to purchase and install equipment. Arrangements to connect to the global Internet must be found. This is called “backhaul connectivity”. Staff or volunteers are required to start and maintain the operations. In many countries, a specific operating license may be needed or, at least an authorisation[13].

Another key issue is access to spectrum[14]. Community Networks need spectrum to employ Wi-Fi and wireless and satellite which connect to the global Internet. Yet the existing regulatory landscape often requires large investments in spectrum. This does not work well for small-scale Community Networks.

Solutions are being found. As previously noted, the European Commission endorsed Community Networks as a complementary business model in its Broadband Investment Guide.[15] Community Networks can receive seed money from the European Investment Bank and draw technical assistance from the European Regional Development Fund. They can obtain small grant funding from non-profits like the Internet Society, Mozilla Foundation and other similar organisations.

A specific European concern centres on state aid. Telecom companies argue, with some justification, that Community Networks often receive unfair aid from their local government supporters. Municipalities have tried to “give away” free access to their municipal infrastructure to some community projects. These fall foul of longstanding rules against illegal public aid that distorts competition.

In order to clarify the situation, the Commission has defined special rules[16] on what constitutes illegal state aid for broadband infrastructure. Public funds and other support are permitted to help fill in connectivity gaps, provided they are “well-targeted, technologically neutral and do not harm competition through crowding out private investment.” The rules also require open access to state-funded infrastructure. Certain categories of aid supporting broadband infrastructure are exempted from going through the lengthy process of notification to competition authorities.

Less progress is visible on the spectrum issue. The European Commission has tried for years to coordinate how national governments allocate so-called wireless spectrum or parcels of airwaves to large mobile operators to create a single European telecoms market. Telecoms companies have also long called for a more coordinated spectrum policy. License durations vary across Europe, making it harder for the companies to operate on a larger scale and compete with US rivals – and harder for community networks to obtain the needed licenses.

Unfortunately, the European Union’s national governments have blocked advances. They insist on keeping control of spectrum, which they can sell to operators to raise billions of euros. In September 2016, the Commission sought to address this by proposing a minimum spectrum license duration of 25 years – only to face opposition from 15 countries. At present, spectrum licenses in Europe are awarded for around 10-15 years, except for Britain, which has awarded unlimited ones. Negotiations on spectrum are being finalized as this report goes to press. The outlook is gloomy for any major changes.

Some countries are taking initiatives to allow use of unlicensed spectrum. In 2013, the Netherlands allocated 5 megahertz (MHz) of spectrum in the 1800 MHz band for unlicensed GSM operators using low-power base stations. Within three years, more than 3,000 organisations established their own private GSM networks. Another possibility is dynamic spectrum sharing, which uses advanced technology to allow different connectivity systems to share the same spectrum. In its new telecom legislation, the European Commission has put forward a proposal for licensed, shared access in the 2.3 GHz band.

Changing Market Environment

Another key obstacle for Community Networks traditionally has come from incumbent telecom companies. Many of these companies started life as government agencies. Although most are now privatized and face competition, the telecom operators have continued to control key infrastructure. They are sometimes able to block fledgling bottom-up networks by demanding exorbitant backhaul connectivity fees and insisting that government obligations require them to have an operating license. In addition, some community networks complain that the quality of the Wi-Fi spectrum left open to them is of poor quality.

From their point of view, the telecom operators saw Community Networks distorting competition, using their non-profit status to gain an unfair competitive advantage.

Over time, however, the two sides seem to be finding ways to work together. The European Telecommunications Network Operators (ETNO) acknowledges that Community Networks are often the best way to service difficult-to-fill in “white zones”. Community Networks, in turn, have managed to succeed and prosper by linking into the main telecommunications networks.

The European Union was putting its finishing touches on a new telecommunications code, expected to be adopted in July 2018. The rules will regulate the sector for the coming decade or more; an early analysis suggests they will do little to change the on-the-ground situation for Community Networks. Supporters of Community Networks fear a missed opportunity. They believe not enough attention was paid to them in writing these new rules. “Smaller players are often forgotten” because they get drowned out by big players, said German Pirate Party MEP Julia Reda, “Our goal must be to bring these voices into the discussion”.

In well-connected, well-funded Europe, the room and need for bottom-up Community Networks is lower than in the developing world. In the larger Europe stretching into Ukraine and the Caucuses, the role for Community Networks looks crucial In these former Soviet regions, connectivity remains much lower than in the European Union – and public funds are tight.

Yet, as the case studies in Part III demonstrate, there are places around Europe where Community Networks fill gaps – particularly in rural areas. Community Networks represent a more affordable way to connect remote populations through sustainable community-led connectivity projects. In many cases, they require less than $50,000 to get off the ground. Motivated citizens mean that the networks can be built quickly and efficiently – often in months rather than years – with some or all of the work done on a volunteer basis.

Part III. Case Studies

Community Networks are not uniform. There is no single model, as each one is adapted to its local environment. Some are designed to provide minimum starter connectivity. Others bring ultra-high speed connectivity upgrades, and some are small, serving only a handful of customers. Others grow out of their original region and reach tens of thousands of users. Some are located in wealthier, developed countries. Others are found in underdeveloped, poor countries. The five examples below provide an overview of this diversity. All are successful and have managed to get off the ground and become financially sustainable. Each one is supported by high levels of local support and engagement.

Guifi, Spain

https://guifi.net/en

https://youtu.be/gD3HYeD4Lm4

In the foothills of the Pyrenees, many isolated Catalan villages are home to thousands of pigs, cows and sheep, but less than 1,000 human beings. Even though their villages are located less than 100 kilometres from Barcelona, no commercial operator was interested in providing them with connectivity. At the turn of the millennium, many villagers had no Internet access.

Residents responded in 2004 by creating what they called the People’s Network, named Guifi.net. Along with 100 local businesses, founder Ramon Roca set up a simple non-profit foundation. Staff consisted of volunteers. Under Spanish law, it proved straightforward to receive the necessary telecommunications license – only a few papers to sign. The cost of the license was minimal, a mere 1.5% of revenues since Guifi Net initially had so few users. “It wasn’t a barrier,” recalls Guifi.net founder Roca. Local municipalities helped out by giving rights of way free of charge and a few minimal subsidies.

The launch technology was simple: radio connections with commodity Wi-Fi routers. Traffic was limited to a maximum of 30 GBps. The non-paid staff fell behind in its accounting.

Problems mounted when the Guifi.net team decided in 2009 that they needed to upgrade to fast fibre optic. The federal and regional government began to put obstacles in its way. A tax was imposed on every meter of fibre laid for using the right of way. Incumbent commercial operators were exempt and began blocking access to public infrastructure.

Guifi.net got around the bottleneck by laying its own fibre. It used water lines already in the ground to run its infrastructure. The main office managing the network in Catalonia built a single room stacked with servers – in the back of a pig farm.

Today, Guifi.net services over 50,000 users. Although most of them are in Catalonia, others are in remote regions inland from Valencia, in the Balearic Islands, Asturias and the Basque Country. This makes it arguably the largest Community Network in the world.

More than 20 telcos offer their commercial services on top of the Guifi.net network. These companies allocate a part of the fees that they charge for their services to the maintenance, upgrading and development of the common network. This allows Guifi.net to offer competitive pricing to consumers, ranging from €28 to €36 per month based on the length of the contract and whether the money is paid upfront.

High-speed Internet connections are transforming the life of local farmers. Dolores Comero and her husband own a pig farm. She used to go to the regional capital of Vic several times a week, to do all her banking and other administrative tasks. Today, she does almost everything from her home office. “It has changed everything,” says her husband Josep Muno. “Everything goes very fast”.

Tusheti, Georgia

https://www.youtube.com/watch?v=tE_BwViCHSU

Talk about isolation and Georgia’s Tusheti region fits the definition. Russia’s invasion of Georgia in 2015 cut off routes to the north. The remaining Abano mountain pass to the capital Tbilisi cuts through narrow gorges. Heavy snow cuts the road for seven months of the year. During that long winter, the only way to reach the region is by helicopter.

No traditional telephone company would think about running an Internet cable through this treacherous terrain to reach only a handful of potential paying customers – only about a dozen households live there all year round. In a country where only 45% of the country’s 3.7 million population is connected, telecom operators concentrate on much easier-to-connect and profitable connections.

Yet Tusheti is an area of spectacular natural beauty, home to a protected national park and soaring medieval castles. Over the past few years, summer tourism has grown and 14,000 tourists visited in 2017. Hotels, restaurants and other businesses catering to tourism required Internet access.

For national security reasons, the Georgian government was eager to make sure that the isolated region – particularly its border guards – was digitally connected to the rest of the country. In stepped Ucha Seturi, the executive director of the Small and Medium Telecom Operators Association, who volunteered to become project coordinator. He worked together with the Tusheti Development Fund. Together, they asked Freenet, one of the small regional Internet service providers, to grant free access to its backbone.

Project coordinator Seturi set out to erect wireless masts in the Abano Pass, 2,500 to 3,500 meters above sea level. Horses were used to carry the equipment to mountain tops. Several ran away or wandered off with the packs on their backs. Sometimes, the mounts and other equipment fell off. This equipment and solar panels withstood intense thunder, wind and snow.

Fortunately, only five masts were required to create a functioning wireless network. Construction, carried out in June 2017, took a mere three weeks and the Internet connections were opened on June 26th, in time for the crucial summer season.

Favourable regulation made possible the blazing-fast rollout. Georgia requires no license to create an Internet network. The Tusheti Development Fund only needed to fill out a little paperwork and pay 0.75% of its revenues as a tax. No right-of-way charges and no extra fees blocked access to state or private property.

Costs were minimal – a small grant from the Internet Society for the wireless masts, solar panels and other infrastructure. As part of the World Bank project, the Georgian government created demand by giving out vouchers to local residents and SMES for about $70 to pay monthly connectivity fees.

Today, Seturi and the he Tusheti Development Fund run the system, with Freenet providing the backhaul. It has a mere 49 customers. Individuals pay only $10 a month. Businesses pay double that amount, about the same rate as most business customers in Georgia. Demand by the local hotels and SMEs accounts for 80% of the monthly revenues of $2,500, subsidisig access to individuals.

Even so, the Tusheti Development Fund, a regional NGO that owns the network, is able to make ends meet. The project is sustainable both in its ability to power itself through solar energy and in the local population now trained to use it. The entire operation requires only four paid staff members, who are assisted by ten other local volunteers. Tusheti shows that a strong Community Network can deliver Internet access in almost the most inaccessible place in the world – quickly

and affordably.

Sarantaporo, Greece

https://www.youtube.com/watch?v=faj8BneJSU0&feature=youtu.be

For the past few decades, young people from the northern mountainous Greek village of Sarantaporo have been leaving for the jobs and bright lights of Greece’s major cities. The municipality’s population dropped from 3,588 in 2,450 in the first decade of this century; the village’s numbers fell even more dramatically, from 907 to 580.

Many people who left the remote region wanted to keep in touch with their parents and friends who stayed behind. The solution? Build a Community Network. In 2010, a small group of Sarantaporo emigres launched Sarantaporo.gr. The village itself was first to be connected. In the three following years, 14 surrounding villages were added to the network.

Costs were kept to the bare minimum. Mesh routers were rolled out to 15 villages for less than €27,000. The yearly costs for running the Community Network infrastructure comes to only €600 per village. Non-paid volunteers installed and maintain the equipment.

Sarantaporo.gr’s business model is built on an assumption that everybody should have free and open access to the Internet. Initially, local cultural associations were assigned to act as middlemen, but they failed to actively engage in the Community Network. Organisers turned directly to citizens. They divvied out equipment among households, placing routers in individual houses. Some of the homeowners were trained to maintain the equipment. They worked as non-paid volunteers but received the right to superior signal.

Initially, the project spent half of its budget in backhaul connectivity, which was provided at a regular market price. After four years, Sarantaporo.gr signed a memorandum of understanding with the University of Applied Sciences of Thessaly, which allowed them to use its backhaul on a pro bono basis for villages that had no alternative connection to the Internet.

A team of three to four volunteers from each village manage the local Community Network. Since most of the team professionals were living in Athens or even further abroad, they could not interact on a daily basis with the locals on the ground. The node owners kept in touch via instant messaging. Travel costs from Athens to the villages represented a large share of the additional costs incurred in this initial phase.

Because Sarantaporo uses only unlicensed WiFi connectivity, it can operate without a license as a non-profit. The Greek regulatory environment is ambiguous. Even though the Greek telecommunications sector is competitive for both fixed and mobile services, the development of broadband infrastructures and services is far behind compared to other EU countries. Broadband take-up has been slow. A strong national strategy for broadband coverage in rural areas – where investments are not profitable – is lacking.

When the Community Network launched, Sarantaporo residents didn’t have any alternative to obtain Internet connectivity. Word of mouth created demand in neighbouring villages.[17] The Internet proved to be a lifeline to the outside world. Villagers were delighted to videoconference with grandchildren and receive medical prescriptions online.

After the start-up phase ended, the Sarantaporo.gr worked to make the project sustainable for the long term. Maintenance costs come to about €600 per village per year. Other ISPs started providing competition. Despite the arrival of “competitors”, Vasilis Chryssos, member of the team, said that no significant changes occurred in terms of pricing and availability of backhaul connectivity.

Today, the Community Network is working to hire two full-time paid staff to ensure continuity of service and sufficient skills levels, and to train local people to organise their own maintenance and support. It is common for node owners and customers to interact via instant message through a Telegram group. Usage is mounting. Over the past year they have had a significant increase in use by local community members. They also have installed new dual-band access points. These dual-band access points are much more stable and efficient than the previous ones, attracting new subscribers.

Over the year, the pricing strategy also changed from an annual subscription fee per village to an annual subscription per node. A pro-bono router is offered for each device bought by customers, so that they can expand their network. Recently, the team filmed a documentary and appeared on a local TV show. They use both mediums as outreach material, which they combine with workshops, trainings and events.

Sarantaporo.gr took part in EU-funded projects, CONFINE[18] and netCommons,[19] and recently received a grant from the Internet Society’s Beyond the Net grant programme. Funds are being used to upgrade equipment and provide training and community building for local communities.

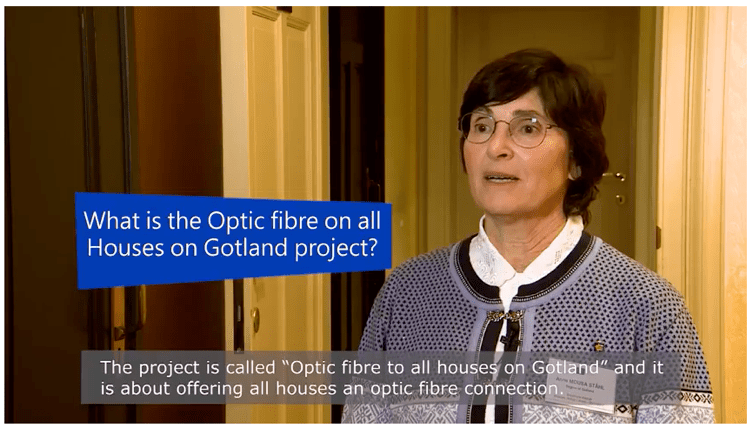

Gotland, Sweden

https://www.youtube.com/watch?v=vMgw5k7oGnU

In Georgia, Greece and Spain, farmers faced the stark issue of getting online. In prosperous Sweden, farmers on the island of Gotland, in the Baltic Sea, faced the issue of improving their service. Until 2010, they got by with slow-speed mobile connections. A Community Network helped bring them high-speed fibre optic connectivity.

Gotland is cold and dark throughout the winter. It counts a year-long population of under 60,000. Some 60% of the population live in the countryside, and the rest live in the small town of Visby (around 24,000 inhabitants). In the summer, however, the island comes alive with 10,000 Swedes with one million visitors.

Back in 2010, no public funding was available to bring high-speed service to Gotland. A former marketing director and IT manager Anne Mousa Ståhl signed up as coordinator of the regional digital agenda with the general goal of improving connectivity. Her challenge was to convince locals, mostly elderly, that the investment in fibre was worth the cost. She started by holding meetings in the local parish halls (the island has 92 active parishes) challenging the locals to form fibre-collectives that would deploy fibre to all the (interested) households and to a local node where one of the three major network providers could connect them with the parish-owned network.

In Sweden, most Internet connections run underground, making them expensive. Ståhl raised €800 per household. Even then, she needed locals to offer their land for the cable rollout and to do the digging for fibre trenches themselves. Ståhl succeeded. Landowners provided land without cost and helped find the best places to dig. Users offered three days of manual labour without cost. Local contractors developed cost-efficient methods. Network providers had to pay €600 per house up-front to reach the end customers. Parishes publicised the project.

These volunteer gifts represented 69% of the total €37.1 million budget. Public spending accounted for a mere 8% or €4.3 million, including €2 million from EU funds and €2.3 million from the Gotland Region. The region’s three telecom incumbents contributed 23% or €12.6 million to provide last-mile services from the parish node to local houses. Operators offered convenient six-year contracts at a fixed low price, around €29 per month.

Thanks to the project, the island’s Internet connection has reached 85% of residents and 55% of summer homeowners. Some 57,000 people in Gotland have access to fibre. Stockholmers with vacation houses in Gotland increased the frequency of their visits, presumably thanks to the better connectivity, according to the Swedish Air Authorities. The island’s full-year population has begun to grow.

Gotland’s experience highlights how a prosperous, already-connected community can come together to improve service by aggregating demand and fund-raising. The community built the business case. It then tendered out the deployment and operation of this network. After the project’s pilot stage was completed, three telcos started competing to cooperate with the parishes, who are the main owners of the fibre. They created new customer bundles, bringing down prices and boosting demand. The Gotland project was awarded the European Broadband Award 2017 for innovative models of financing, business and investment.

Scani (Yonne)

France

Community networks are not just useful in far-off, difficult-to-reach regions. They also fill in gaps in prosperous countries in easy-to-reach places. A case in point is Scani in the Yonne region, only an hour and a half drive from Paris, in the centre of France, and set amid the lush Burgundian countryside.

Despite France’s overall strong connectivity rates, many of the rich country’s rural regions do not have high-speed connectivity. As recently as 2011, many areas were limited to 512,000 connections. Scani began in 2013 as a mere association and has built itself into a true cooperative, including paid staff (rather than just volunteers) and one of the first French Community Networks to foray into the deployment of last-mile fibre-optic connectivity.

Two locals offered the initial €6,000 in funds. Scani cooperates with the national federation of non-profit ISPs, La fédération des Fournisseurs d’Accès à Internet (FDN),[20] whose network is based on virtual private networks (VPNs) connections sold at regular market prices. Users pay €30 per month, which is aligned to the market prices. The equipment costs were around 40% of the revenues in the first three years, and maintenance costs were low.

Crucially, thanks to a helpful regulatory change, operator licenses were free. Previously, Community Networks in France needed to pay €20,000 for a license. Scani achieved the break-even point in the summer of 2013, after six months – and the two initial investors were reimbursed.

Up until the summer of 2017, the cooperative depended on five volunteers. Customers hired professionals for their own installations and network maintenance. “We need professionals for the dangerous work such as climbing on roofs digging a trench which requires machines.” says founder Bruno Spiquel.

Scani hired a training director last year and provides him with a €3,000 per month budget. The cooperative makes regular calls to the community to fund various projects – the last one was for 50% of the setup fees of a new fibre back hole. The next funding request will be to pay for racks in a data centre that will allow faster traffic exchange in the network and will open direct connections to the South of France. People subscribe to new shares of Scani to fund these operations.

Even so, the goals are small and social. Scani connected 40 households in its first year and 150 after three years. “We didn’t have any commercial purpose. We don’t have to generate demand”, says founder Spiquel. “If someone wants to connect to the network, we help. If he wants to stay put in his chair waiting for the connection, he will probably never get it. That’s it.”

Part IV. Lessons Learned

These case studies teach us important lessons about connecting the hardest-to-connect populations. No one suggests that Community Networks represent the sole solution for bringing high-speed Internet to most of Europe. They do, however, represent a complementary way to provide connectivity.

Community networks offer a realistic solution to accelerate connectivity. Instead of waiting for others to bring Internet connectivity, residents take up the cause themselves. These are just some of the lessons we learned from our case studies.

- Capital spending. The greatest single takeaway is how little it can cost to connect rural regions. In our case studies, wireless or overground infrastructure cost less than €50,000. In most cases studied, the cost to the consumers of a monthly subscription was similar or even less than what was offered by commercial operators. Unneeded obligations to lay fibre optic cables below ground represent a major hurdle. The only case study with significant capital spending requirements was in Sweden, where it was required to lay cables underground. Basic Wi-Fi or above ground connections proved less capital-intensive.

- Fundraising and Partnerships. Various successful options exist to collect funds to build up initial deployment: external grants, government subsidies and user funds. Partnerships often are required with local and regional ISPs to support backhaul and maintenance.

- Operating costs. A key to start a community network was putting an arrangement in place to allow backhaul connectivity to the global Internet. This should be a win-win arrangement. Commercial ISPs will not go to hard-to-reach places because the business case did not add up. Community Networks bring more business to the telecommunications operators than they take away. Over time, though, renewal of equipment in harsh geographical condition could prove problematic.

- Human Resources. Volunteering is helpful in the launch phase of many Community Networks. In most cases, however, it is necessary to hire paid staff. Even the most counterculture example we studied, France’s Scani, has ended up hiring a professional director after three years in operation. Of our five Community Network case studies, all ended up engaging at least a minimum professional staff.

- Operating license. In many countries, an official operating license is required to become a network operator. Keeping the cost minimal or giving away this license free of charge is key to launching a successful Community Network of our five case studies, four benefited from easy access to an operating license.

- Efficient regulation. The existing regulatory landscape developed for large, for-profit telecommunications companies often is not compatible with small bottom-up Community Networks. Throughout Europe, though, our case studies are showing that governments are creating enabling regulations and policies to fit not-for-profit and small commercial operators. Burdensome reporting requirements have been simplified and streamlined. State aid rules have been clarified, and unlicensed spectrum opened to WiFi.

Despite these moves forward, hurdles remain for Community Networks in Europe. Governments have blocked most efforts to open up spectrum. Capacity building and training remains insufficient. Europe’s reliance on public top-down funding schemes is almost sure to be wasteful and more inefficient than the bottom-up user-generated approach.

Community Networks represent a viable and efficient alternative to these expensive publicly funded layouts, particularly in hard-to-reach regions. The Community Networks in these case studies supplied as few as 50 customers – or as many as 50,000. The number of subscribers was not essential to success, since start-up and maintenance costs were kept low.

Community Networks are not run as commercial businesses. They fill a crucial need. Once launched, some Community Networks become part of regular commercial operations. This should not be seen as a tragedy, but as a success. The Community Network has served its purpose. purpose, bringing connectivity to hard-to-reach, unconnected regions.

About the Authors

William Echikson

William Echikson is Associate Senior Fellow and Director of the Digital Forum at the Centre for European Policy Studies in Brussels.

Before joining CEPS, Mr. Echikson worked for six and a half years at Google, running corporate communications for Europe, Middle East and Africa. He launched the company’s Europe blog and led its efforts around data centre government affairs and Internet freedom Issues.

Mr. Echikson began his career as a foreign correspondent in Europe for a series of US publications including the Christian Science Monitor, Wall Street Journal, Fortune and BusinessWeek. From 2001 until 2007, he served as the Brussels Bureau Chief for Dow Jones.

Mr. Echikson also has written, directed and produced television documentaries for BBC and the US Public Broadcasting Service. He is the author of four books, including works on the collapse of communism in Central Europe and the history of the Bordeaux wine region.

An American and Belgian citizen, Mr. Echikson graduated from Yale College with a Magna Cum Laude degree in history.

Antonella Zarra

Antonella Zarra is a Research Assistant within the Regulatory Policy Unit at CEPS.

Prior to joining CEPS, Antonella worked for the Public and Regulatory Affairs department of Telecom Italia (TIM) and for the European Telecommunications Network Operators association (ETNO) in Brussels. In 2015 she carried out a traineeship at the European Commission DG Competition, as a data analyst within the Task Force on the Digital Single Market dealing with the sector’s inquiries on e-commerce.

She has gained expertise in the fields of telecoms regulation, Internet policy and competition law. Previously, Ms Zarra has worked at the Public Administration Department of the Italian Government. She holds a summa cum laude Master’s Degree in Economics and Management of Public Administration and International Institutions from Bocconi University in Milan and spent a semester studying at the National Chengchi University of Taipei, Taiwan.

Notes

[1] International Telecommunication Union, “Measuring the Information Society Report”, Vol. 1, Geneva, 2017.

[2] European Commission, “Broadband High-Speed Investment”, October 2014.

[3] See European Commission Communication, “Connectivity for a Competitive Digital Single Market – Towards a European Gigabit Society”, 2018.

[4] Freedom House, Freedom of the Net 2017 (https://freedomhouse.org/report/freedom-net/freedom-net-2017).

[5] Freedom House, Freedom of the Net 2017 (https://freedomhouse.org/report/freedom-net/freedom-net-2017).

[6] Rural areas are defined as sparsely-populated regions, with less than 100 inhabitants/km2.

[7] Eurostat, Statistics on rural areas in the EU, 2017 (http://ec.europa.eu/eurostat/statistics-explained/index.php/Statistics_on_rural_areas_in_the_EU).

[8] European Court of Auditors, Audit brief, Broadband in the EU, September 2017.

[9] European Commission, Broadband Investment Guide (http://ec.europa.eu/newsroom/dae/document.cfm?action=display&doc_id=6908).

[10] European Commission, Study on broadband coverage in Europe 2016

(https://ec.europa.eu/digital-single-market/en/news/study-broadband-coverage-europe-2016).

[11] Letter to EU Institutions: WIFI4EU must promote diversity, locality and Human rights, 22 May 2017 (https://www.laquadrature.net/en/wifi4eu-diversity-human-rights).

[12] European Commission, Study on broadband coverage in Europe 2016

(https://ec.europa.eu/digital-single-market/en/news/study-broadband-coverage-europe-2016).

[13] Internet Society: Unleashing Community Networks: Innovative Licensing Approaches (https://www.Internetsociety.org/resources/2018/unleashing-community-networks-innovative-licensing-approaches/)

[14] Internet Society: Policy Brief: Spectrum Approaches for Community Networks (https://www.Internetsociety.org/policybriefs/spectrum/)

[15] European Commission, Broadband Investment Guide (http://ec.europa.eu/newsroom/dae/document.cfm?action=display&doc_id=6908).

[16] European Commission Press release, State aid: Commission adopts new Broadband Guidelines

(http://europa.eu/rapid/press-release_IP-12-1424_en.htm).

[17] As anticipated, the yearly price negotiated was around €600 per village at the beginning (with the local cultural association acting as a mediator), whereas node owners now pay €60 per year to the organisation.

[18] CONFINE Project, Community Networks Testbed for the Future Internet: http://confine-project.eu/