Introduction

The Internet provides significant economic and social benefits for countries, regardless of their current state of development. It enables developing countries to grow and helps to meet the United Nations Sustainable Development Goals; it enables emerging economies to accelerate the process of joining the global economy; and it helps more advanced countries sustain their progress and develop a competitive advantage.

For users, it facilitates online education and access to digital healthcare, and it can provide training and help to find employment. The Internet can also help entrepreneurs to turn their ideas into innovations, and their innovations into income, and enable existing companies to become more efficient and access global markets. Internet applications can bring together families, friends, and colleagues, they can help citizens interact with their governments, and they can provide news and entertainment.

The Internet Society has long supported and promoted the development of the Internet as a global technical infrastructure, a resource to enrich people’s lives, and a force for good in society. In this mission, we have developed a policy framework for enabling Internet access that has three components: expanding infrastructure; fostering skills and entrepreneurship; and supportive governance.[1] In this paper we focus on expanding and upgrading infrastructure in the Middle East and North Africa region.

The paper builds on a large body of work conducted by the Internet Society with relation to barriers to investment in infrastructure,[2] the benefits of having local Internet traffic exchange points,[3] the benefits of hosting content in the country,[4] the means to promote the development of content,[5] and to develop an Internet economy.[6] While these papers were written for other regions, they developed a number of relevant learnings and concepts.

The newly established Internet Society Middle East Bureau now seeks to apply the learning of those papers to the Middle East and North Africa (MENA) region; papers on the other elements of the enabling environment – capacity building and governance – will follow. This paper builds on a significant level of engagement in the region, based on workshops in Saudi Arabia, Kuwait, and Oman attended by participants throughout the region, as well as discussions and inputs from stakeholders throughout the region.

Overview of Internet infrastructure

Internet infrastructure is a means to an end. It brings people online to be able to access the Internet anytime anywhere, and to encourage more local skills and literacy training. It helps build and enhance businesses, and enables companies to host their content and services for local and regional usage. Beyond the infrastructure, more and more countries are finding it important to build a digital economy to enable more local content and services to be produced that will fill data centers and increase use of local Internet exchange points. The digital economy, in turn, is a stepping stone to the digital transformation of the entire economy, in which all organisations and citizens – business, government, research, students and others, are fully online and part of the global Internet.

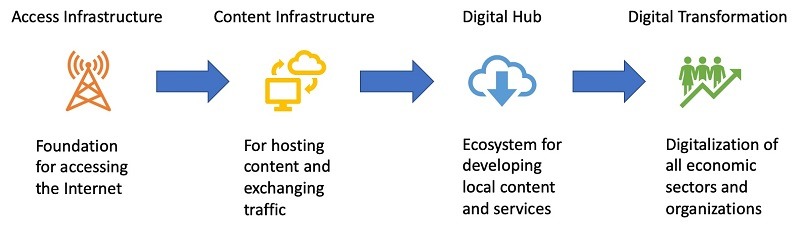

In this paper we focus on the Internet infrastructure, policies, and efforts needed to develop a digital economy, as seen in Figure 1.

- Access infrastructure. This is the entire value chain of infrastructure that carries traffic to and from international points; delivers the traffic throughout the country on a national basis; and connects users to the Internet in order to access relevant content and services.

- Content infrastructure. This includes Internet Exchange Points (IXPs) where traffic can be exchanged on a local basis, and data centers, where content and applications can be hosted. Using local content infrastructure lowers the time and cost needed to deliver traffic and access content, improves quality of service, and strengthens the capacity of local experts, which in turn helps to promote Internet adoption and usage.

- Digital economy. This is the ecosystem to create online content and services to fully utilize the access and content infrastructure. A digital economy enables entrepreneurs to innovate while also providing consumers with the ability to use their new online services, and it helps bring existing sectors online to transform the entire economy. [7]

Figure 1: Overview of Internet Infrastructure Impact (Internet Society)

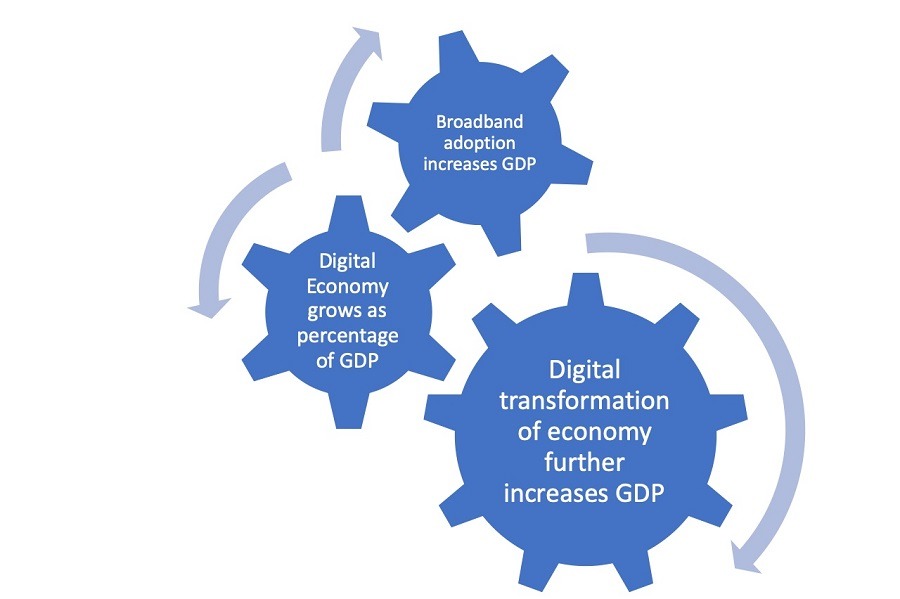

The economic benefits of developing Internet infrastructure are significant, at three separate levels, as summarized in Figure 2.

- A long series of studies has shown that increased adoption of broadband increases the Gross Domestic Product (GDP) of the country. For instance, a recent study showed that a one percent increase in fixed broadband adoption increases GDP by 0.08%, while the same increase in mobile broadband adoption increases GDP by 0.15%. As adoption grows within the region, this can accumulate to significant increases in GDP.[8]

- In economic terms, the digital economy can be measured as a percentage of a country’s total GDP, and typically contributes a single digit amount. According to one study, the share of the digital contribution to GDP in the US was 8%, in the leading European economies was 6.2%, and in a leading sample of Middle East countries, was 4.1%.[9] Within the Middle East, the percentage varied from 8% in Bahrain to 0.4% in Qatar. Given that the digital economy provides good jobs and incomes, growing the contribution in each country to the US level or beyond is already a significant benefit.

- Further, using the digital economy to transform the rest of the economy of a country, as measured by a digitization index presented by the ITU, will lead to further increases in GDP. According to an ITU study “Achieving broadband penetration is only one aspect of required policies; maximization of economic impact can only be achieved through a holistic set of policies ranging from telecommunications to computing to adoption of Internet and electronic commerce.” [10]

Figure 2: Overview of Economic Benefits (Internet Society)

Overview of MENA region

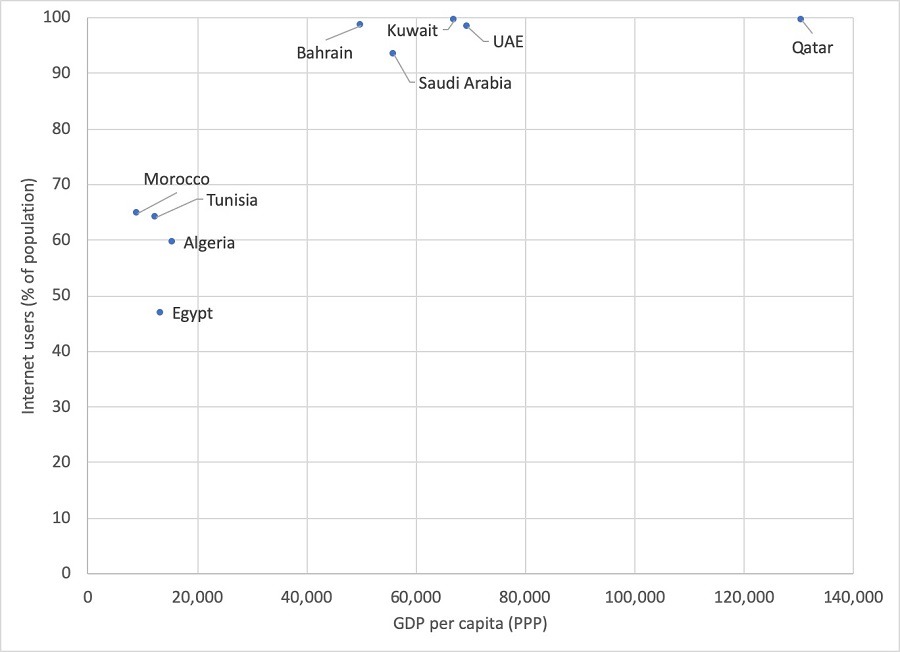

The MENA region has an open definition in terms of the countries included, so we will take a broad definition to ensure general applicability of our report and recommendations. While the countries share a number of attributes such as geography and language, there are a number of significant differences. Figure 3 below highlights two relevant differences: the level of GDP per capita[11], reflecting the wealth of each country; and the percentage of the population who are currently using the Internet, reflecting different stages of Internet development.

Broadly speaking, there are two groups of countries; those with GDP above USD 40,000 per capita, whose Internet penetration exceeds 90% and even approaches 100%, and those with GDP under USD 20,000 per capita, whose Internet penetration is below 70%. GDP per capita clearly has an impact on Internet adoption levels, both because users have more disposable income for Internet, and also because there are likely to be more resources – both in the private sector and in the government – to invest in infrastructure. Other factors include higher literacy and education, and likely higher level of relevant local content to address a wealthier market.

That said, policies can make a difference in the levels of Internet adoption. For instance, we can see on the left-hand side of the graph that Morocco, with the lowest per capita income in that group, has the highest Internet penetration levels, which implies that Morocco may have some policy best practices to consider. On the right-hand side of the graph, Bahrain has the lowest income level of that group, but higher Internet adoption than Saudi Arabia and UAE, with higher income levels, and a rate effectively equal to Qatar, with much higher income levels. Again, that suggests policy best practices worthy of consideration.

Figure 3: GDP per capita (PPP) and Internet adoption in MENA (IMF, ITU, 2018)[12]

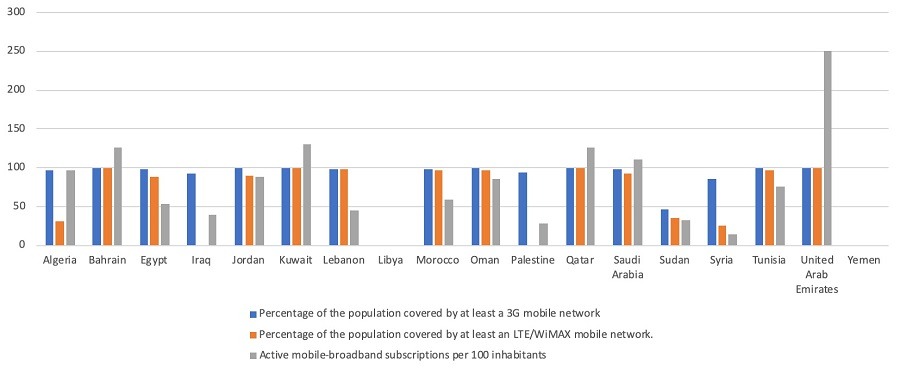

These differences hold as we also examine the means by which individuals and households go online, namely mobile and fixed broadband access. For both types of access there are three sets of interesting questions – what is the level of population coverage, what technology is being used, and what is the adoption level? Starting with mobile, we can identify several different cases as per the below Figure 4, which highlights the eighteen countries in MENA that are the focus of this study. [13]

Figure 4: Mobile broadband availability and adoption (ITU 2018)

Figure 4 highlights the percentage of the population covered by a 3G mobile network and covered by LTE/WiMAX (4G). Note that this relates to population, rather than geographic territory covered, but gives a good indication of coverage for the populated areas in a country where mobile broadband can be used. The graph also gives the number of active mobile broadband subscriptions per population. Note that this counts multiple subscriptions per person, as can be seen by the countries with greater than 100% subscriptions, such as most notably United Arab Emirates. With respect to the three questions:

- Overall the population coverage level for at least 3G is generally quite high, at or near 100%, other than several countries, mostly notably Sudan, which do not have full coverage. For these countries, the focus should be on increased deployment.

- In addition, in many countries the 4G coverage is at or near the 3G level, with the exception of a few countries such as Algeria. For these countries, the focus should include upgrading existing networks.

- The adoption levels tend to be quite high, including multiple subscriptions, but in some countries, there is a significant gap between the availability and adoption of mobile broadband, for instance Egypt and Lebanon. This suggests a focus on increasing demand, by making mobile broadband more affordable and providing more relevant content and services.

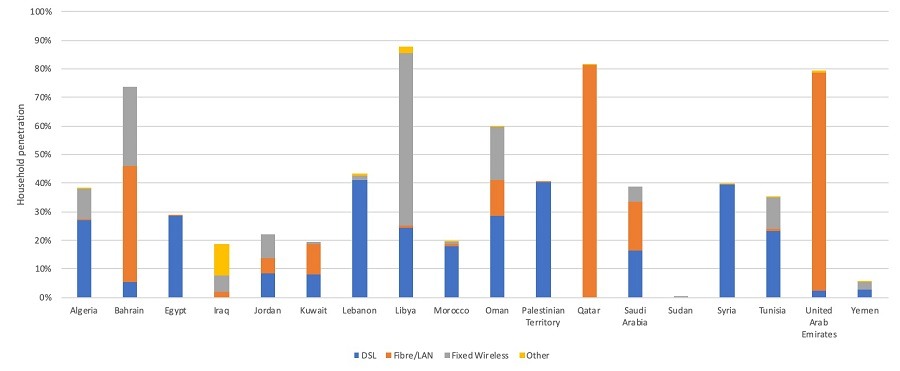

A similar analysis can be done for fixed broadband, as shown below. One difference is that the population coverage of any particular technology is not known, unlike the case of mobile broadband. Instead, the figure below shows the percentage of households that have adopted fixed broadband according to the height of each country’s column, and then within the column it shows the level of adoption of each technology, whether it is DSL, fixed wireless, or the more advanced fiber or LAN solution.

Figure 5: Fixed broadband technology and adoption (TeleGeography 2018)

The countries show considerable variation, from Sudan with little fixed broadband adoption, to Libya with almost 90% of households with broadband adoption. Further, a number of countries have little or no fiber to the home, such as Egypt and Lebanon, although in Egypt we note that Telecom Egypt has put fiber to the curb (FTTC) in 90% of their fixed broadband network, with the goal of achieving 100% by mid-2020. On the other hand, Qatar and UAE are essentially all fiber to the home access, with a very high penetration rate.[14] In the latter countries, some copper was replaced with fiber, and where there was no copper network, the buildout went straight to fiber. It is worth noting that these countries with the highest level of FTTH are very urbanized, and thus the cost of deployment is lower than in the countries with less population density.

With respect to content infrastructure, there is again variation within the region. The table below shows that from the eighteen countries in MENA sampled, 9 of them have an IXP listed with TeleGeography, with some of them having more than one. Further, 14 countries have at least 70 data centres.

In terms of a presence in the data centres, we have sampled several companies delivering content, either their own or third-party content, which have published maps of their points of presence (PoPs). Google has three levels of network presence for delivering its own content – first, putting in a Google Global Cache, with static content such as YouTube videos. 17 of the 18 countries have at least one of these. Next is an Edge Point of Presence, where Google has built out its network and peers with ISPs; two countries have an Edge PoP. Google does not have a data centre in the region, which represents its largest level of investment and presence. Three independent content delivery networks (CDNs), Akamai, Cloudflare and Limelight, have PoPs in up to 12 countries in the region.

The data in Table 1 is expanded at the country level below in Table 3 and Table 5, in Section 3.

Table 1: Content infrastructure in MENA (TeleGeography Internet Exchange Map; PeeringDB; Packet Clearing House; Data Center Map; Google, Cloudflare, Akamai (2019)

|

Content Infrastructure |

Number of Occurrences |

Number of Countries |

|

IXP |

12 |

9 |

|

Data Centres |

72 |

14 |

|

Google Global Cache |

48 |

17 |

|

Google Edge PoP |

2 |

2 |

|

Akamai presence |

19 |

11 |

|

Cloudflare presence |

12 |

12 |

|

Limelight presence |

4 |

4 |

It is critical to build Internet infrastructure, but also to develop a digital economy in order to create the content and services that leverage the infrastructure. While countries in the region are working to promote innovation, according to the latest Global Innovation Index from the World Intellectual Property Organisation (WIPO), no country in the region ranks higher than 36th, and several are ranked below 100. This index ranked 129 countries on their innovation performance, looking both at the inputs, including education and infrastructure, and outputs, such as mobile app creation.[15]

One important aspect of developing a digital economy is the ability to buy and sell online. Particularly in countries with little traditional financial inclusion, mobile money – using a mobile phone to transfer funds and purchase items — provides a means to transact digitally with other individuals and businesses. However, eleven of the countries do not have mobile money, according to GSMA, making it difficult to participate in the digital economy.[16]

Approach to analysis and recommendations

Given the differences between the countries in terms of both access infrastructure and content infrastructure, we will take a tiered approach to the analysis and recommendations.

- Access infrastructure. The focus for all countries is on increasing the availability of next generation mobile and fixed technology. This will help countries extend their networks, while it will enable the countries with less developed networks to ‘leap-frog’ to new technologies. In addition to last mile access networks, international and national networks are needed to support the last mile networks with sufficient bandwidth. It is also important to focus on adoption, by increasing affordability and the availability of relevant content and services.

- Content infrastructure. The countries with existing content infrastructure can level up their current IXP(s), and build new IXPs as networks expand to other cities. The countries can also increase the number of data centers, while encouraging companies to host more content in the country. The less developed countries can seek to build IXPs, and data centers, and increase the presence of CDNs. Many of the recommendations across the countries will be similar in this respect.

- Digital Economy. All countries have an incentive to develop or improve their digital economy – the ability to build infrastructure, host content, and attract investment from high-tech companies, while building a local high-tech sector. Training local people for high-tech sustainability is critical to this effort. By doing this, countries will increase the level of development, particularly in high-tech sectors that provide attractive revenue and job opportunities. It is valuable for all countries to try to get a first-mover advantage in emerging products or services to help gain an edge in the ongoing process of digital transformation of the economy.

The report examines each of these areas of infrastructure in turn, with recommendations and next steps.

Acknowledgments:

This report was developed in consultation with experts in the Middle East and North Africa, and members and staff of the Internet Society, including chapters in the region.

The Internet Society particularly wishes to thank the following institutions and their staff for their support of our consultative process;

- The Kingdom of Saudi Arabia, for hosting a consultative workshop, June 2019

- The State of Kuwait, for hosting a consultative workshop, September, 2019

- The Sultanate of Oman, for hosting a consultative workshop, November, 2019

The Internet Society is grateful to regional experts who participated in these workshops for their active participation in this process and valuable contributions, including the following institutions who reviewed the report and provided expert input.

- The Ministry of Digital Economy and Entrepreneurship and the Telecommunications Regulation Authority of the Hashemite Kingdom of Jordan

- The Telecommunications Regulatory Authority of the Sultanate of Oman

- The National Telecom Regulatory Authority of the Arab Republic of Egypt

- The Ministry of Telecom and Information Technology of the State of Palestine

- The Communication and Information Technology Regulatory Authority of the State of Kuwait

- The Telecommunications Regulatory Authority of the United Arab Emirates

- The Telecommunication and Postal Regulatory Authority of the Republic of the Sudan

- The Tunisian Internet Agency of the Republic of Tunisia

The author of this report is Michael Kende, and he would like to thank Nermine El Saadany for her leadership, and Sally Wentworth, Jane Coffin, Konstantinos Komaitis, Olaf Kolkman, Michuki Mwangi, David Belson, Aftab Siddiqui, Salam Yamout, Max Stucchi, and Andrei Robachesvsky for their input and advice.

Endnotes

[1] “A Policy Framework for Enabling Internet Access” (Internet Society, April 2017), https://www.internetsociety.org/wp-content/uploads/2017/08/bp-EnablingEnvironment-20170411-en.pdf.

[2] Robert Schumann and Michael Kende, “Lifting Barriers to Internet Development in Africa: Suggestions for Improving Connectivity,” Report for the Internet Society, 2013, https://www.internetsociety.org/wp-content/uploads/2017/08/Barriers20to20Internet20in20Africa20Internet20Society_0.pdf.

[3] Michael Kende and Charles Hurpy, “Assessment of the Impact of Internet Exchange Points – Empirical Study of Kenya and Nigeria,” Report for the Internet Society, April 2012, https://www.internetsociety.org/wp-content/uploads/2017/09/Assessment-of-the-impact-of-Internet-Exchange-Points-–-empirical-study-of-Kenya-and-Nigeria.pdf.

[4] Michael Kende and Karen Rose, “Promoting Local Content Hosting to Develop the Internet Ecosystem” (Internet Society, January 2015), https://www.afpif.org/wp-content/uploads/2017/10/Promoting-Local-Content-Hosting-to-Develop-the-Internet-Ecosystem.pdf. Michael Kende and Bastiaan Quast, “The Benefits of Local Content Hosting: A Case Study” (Internet Society, May 2017), https://www.internetsociety.org/wp-content/uploads/2017/08/ISOC_LocalContentRwanda_report_20170505.pdf.

[5] Michael Kende and Bastiaan Quast, “Promoting Content in Africa” (Internet Society, August 2016), https://www.internetsociety.org/wp-content/uploads/2017/08/Promoting20Content20In20Africa.pdf.

[6] Michael Kende, “Promoting the African Internet Economy” (Internet Society, November 22, 2017), https://www.internetsociety.org/wp-content/uploads/2017/11/AfricaInternetEconomy_111517.pdf.

[7] Some countries in the region and elsewhere refer to this as the development of a ‘digital hub’, which is a digital economy as we describe it, with aspirations to serve other countries in the region. We focus on the digital economy as the foundation to transform the entire economy of the country, and acknowledge that additional benefits could derive from serving the greater MENA region.

[8] An early study was Christine Zhen-Wei Qiang, Carlo M Rossotto, and Kaoru Kimura, “Economic Impacts of Broadband,” in Information and Communications for Development 2009: Extending Reach and Increasing Impact (World Bank Group, 2009), http://siteresources.worldbank.org/EXTIC4D/Resources/IC4D_Broadband_35_50.pdf. More recently, see Raul Katz and Fernando Callorda. 2018. The economic contribution of broadband, digitization and ICT regulation. https://www.itu.int/en/ITU-D/Regulatory-Market/Documents/FINAL_1d_18-00513_Broadband-and-Digital-Transformation-E.pdf

[9] Europe included France, Germany, Italy, Sweden, and the United Kingdom. The Middle East included Bahrain (8.0%), Kuwait (5.1%), Egypt (4.4%), United Arab Emirates (4.3%), Saudi Arabia (3.8%), Oman (0.8%), and Qatar (0.4$). “Digital Middle East: Transforming the Region into a Leading Digital Economy” (Digital McKinsey, October 2016), https://www.mckinsey.com/~/media/mckinsey/featured%20insights/middle%20east%20and%20africa/digital%20middle%20east%20transforming%20the%20region%20into%20a%20leading%20digital%20economy/digital-middle-east-final-updated.ashx.

[10] Katz and Callorda, 2018, p. 22.

[11] Given the differences in stages of development of the countries across MENA, for GDP per capita, we use purchasing power parity (PPP) exchange rates, which provide a good measure of well-being, which in turn would drive decisions to adopt broadband. See https://www.imf.org/external/pubs/ft/fandd/2007/03/basics.htm.

[12] These are the countries in MENA for which the ITU has data on Internet adoption for 2018.

[13] Note that the ITU does not have mobile broadband data for Yemen or Libya.

[14] According to the FTTH Council Europe, the top ranked countries in the world for FTTH penetration are UAE and then Qatar. See Roland Montagne, “FTTH Council Europe – Panorama: Europe Broadband Status” (idate, March 12, 2019).

[15] See https://www.globalinnovationindex.org/Home.

[16] See https://www.gsma.com/mobilemoneymetrics/#deployment-tracker.